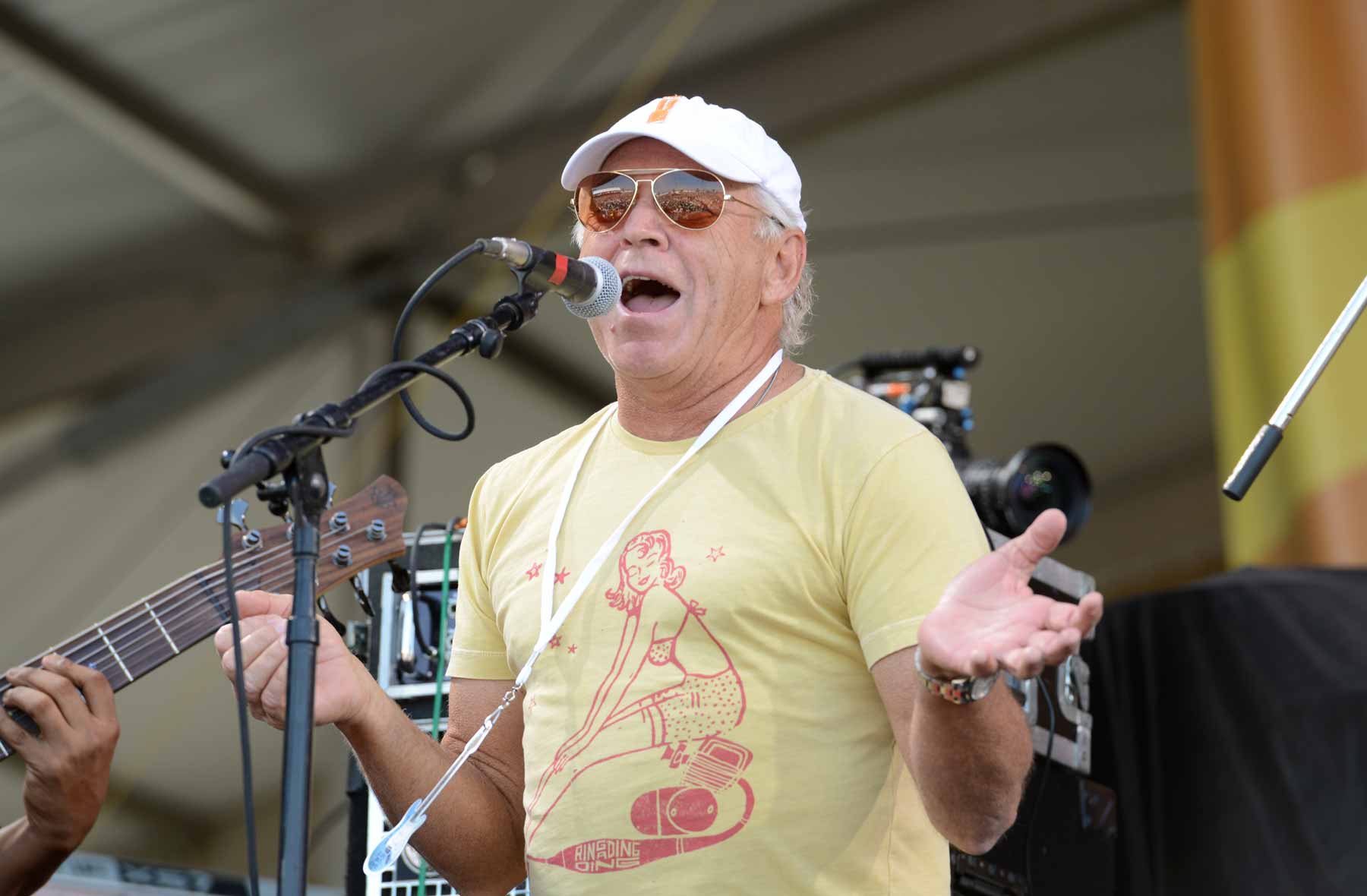

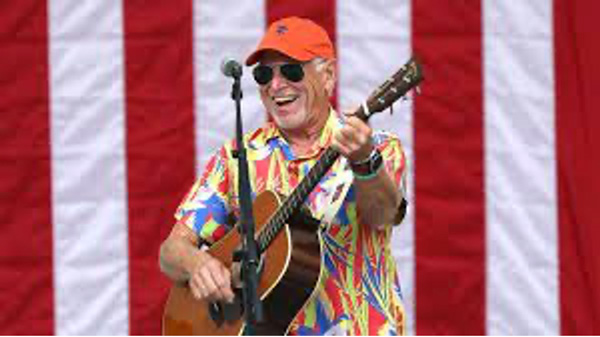

Hope you are all doing well and enjoying your holiday weekend. The three major U.S. large-cap stock indexes posted weekly gains and the NASDAQ and the S&P 500 both outperformed the Dow by wide margins, repeating a pattern from the previous week. In terms of market capitalization, a small-cap benchmark significantly outpaced its large-cap peers. The S&P 500’s positive momentum over the latter half of August wasn’t enough to offset its decline earlier in the month, and the index fell about 1.8%, snapping a string of five positive monthly results. Parrotheads everywhere are mourning the loss of Jimmy Buffett this week, I have broken down this week’s update using some of his iconic songs and lyrics.

It’s 5 O’Clock Somewhere

Americans are still getting paid by the hour and older by the minute. Average hourly earnings were up 4.3% year over year according to the August jobs report. This fell in line with expectations but it is slightly below July’s 4.4%. Wage growth is a key driver of inflation and therefore important to watch. The Fed needs this figure to fall under 4% to have any shot at hitting its 2% inflation target. The labor market, while still strong, seems to be finally starting to feel the impact of higher interest rates. August’s monthly U.S. jobs gain of 187,000 was well below the monthly average of 271,000 jobs over the past 12 months. The unemployment rate rose from 3.5% to 3.8%, the increase was attributed in part to growth in the number of people entering the workforce.

Margaritaville

Corporate earnings are wastin’ away again. Earning season concluded and companies in the S&P 500 recorded an average earnings decline of 4.1% versus the same quarter a year earlier. That result marked the third consecutive quarterly earnings decline. For the second quarter in a row, the consumer discretionary companies like Starbucks have been the frozen concoction that helps (the market) hang on, hang on, hang on, hang on. The consumer discretionary sector posted the strongest earnings growth rate of all 11 sectors, posting another quarter of earning growth that exceeded 50%.

Cheeseburger in Paradise.

Prices are starting to rise again on lettuce and tomato, Heinz 57 and french fried potatoes, big kosher pickle and cold draft beer and just about everything else. The U.S. Federal Reserve’s preferred gauge for tracking inflation showed that consumer prices edged higher in July. The Personal Consumption Expenditures Price Index rose at a 3.3% annual rate, up from 3.0% in June. Excluding volatile prices of food (like cheeseburgers) and energy prices, core inflation climbed 4.2% in July versus 4.1% in June. Inflation had been trending lower so this uptick will bear watching as further increases could prompt the Fed to raise rates further.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.