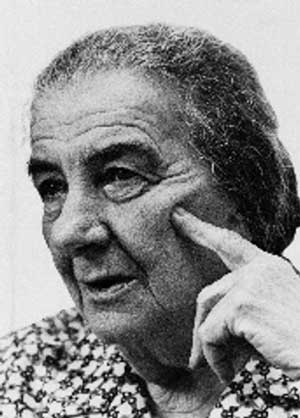

Hope you are all doing well. The S&P 500 and the NASDAQ posted overall gains for the first time in four weeks but the Dow finished in negative territory again, if only slightly. The NASDAQ outperformed its peers by a wide margin, despite sustaining a nearly 2% decline on Thursday. The Golda Meir bio-pic was released in theaters this weekend. I have used some of her more memorable quotes to break down this week’s update.

It isn’t enough to be liked by the people. You must also be right.

U.S. Federal Reserve Chair Jerome Powell like Golda understands the importance of leadership based on principles as opposed to approval seeking. Powell said on Friday that the Fed is prepared to approve further interest-rate increases. It may not be the message the market wanted to hear but it is the correct approach. Two percent inflation is still and will remain the Fed’s target. Chair Powell pushed back on speculation that the Fed could abandon its mandate of price stability and raise its inflation target. The message from the Fed has been consistent. They won’t hesitate to raise interest rates further if needed. This will keep borrowing costs high until inflation is on a convincing path toward the Fed’s 2% target. Expect rates staying higher for longer. That could mean that we eventually see a slight recession and an increase in unemployment. It doesn’t change my opinion that the market rally will have another leg higher later in the year.

You’ll never find a better sparring partner than adversity

Bonds remain under pressure and longer term bonds are still not a good investment.That being said, the higher-interest-rates will better help cushion price declines. Each successive rate hike does less and less damage to bond prices.The recent adversity in the bond market caused yields to spike and sent bond prices down by 2.7%. Compare that to the initial spike in yields when 10-year yield was at 1.6% in the beginning of 2022.Over a similar 3 month period we experienced a similar rise in yields.The initial spike translated to a 5.3% decline in the U.S. Aggregate bond index as opposed to the aforementioned 2.7% decline this time. A decline is still a decline and long term bond prices will continue to struggle if rates keep moving higher. Based on the comment this week there is clearly potential for further rate hikes.That is why I still don’t like longer term bonds. I do like short-term U.S. Treasuries. Those yields are moving even higher, as the 2-year yield jumped on Friday to around 5.06%. You have less sensitivity to rate increases in short term bonds because your money will mature and you will be able to take advantage of the higher rates at maturity. It’s been more than 20 years since the last time the 2-year yield remained above 5.00% for an extended period.

I must govern the clock, not be governed by it.

We have seen a pull back in the big tech stocks that have led the way for much of the year. If they continue to sell off further, don’t panic and move out of stocks. These drops are an opportunity to buy, not a time to sell. We were reminded by Nvidia this week why the market still has room to run. There is palpable excitement around artificial intelligence (AI). AI could drive profit at several of the top tech companies for years if not decades. Those top tech companies happen to comprise about 30% of the US stock market index. So logic dictates U.S. large-cap stocks remain a strong investment, even if the people on TV start screaming sell, sell, sell. The poster child for the power of AI on the corporate bottom line is Nvidia. The company has more than doubled its revenue year over year and its profit has gone from 656 million dollars a year ago to over 6 billion dollars today. The blowout quarter will hopefully remind investors that the implementation of AI is still in its early stages and that it is going to remain a prominent theme.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.