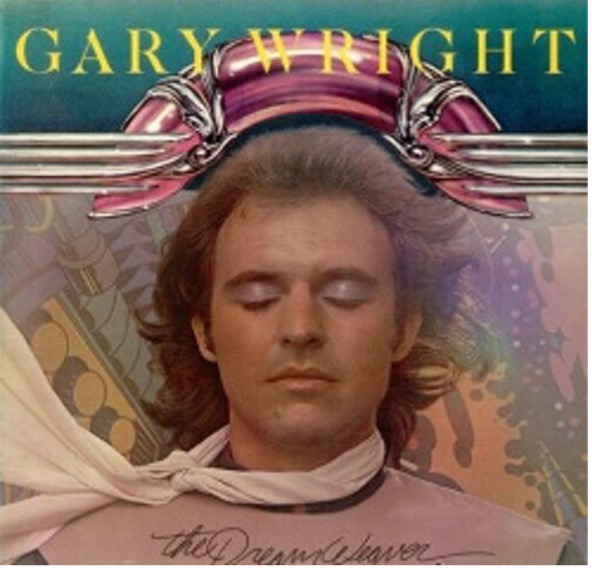

Hope you are all doing well. The major U.S. stock indexes fell around 1% to 2%, giving up most of the ground they had gained in the previous week. In a reversal of the prior week’s results, the NASDAQ underperformed the S&P 500 and the Dow, owing in part to sharp midweek declines for some of the market’s biggest technology stocks. U.S. small-cap stocks fell about 3.6% for the week, extending a recent run of underperformance for the asset class. Stocks are still down since the end of July, with smaller company stocks down around 7.6% versus a 2.9% decline for larger company stocks. Gary Wright passed away this week. I have broken down this week’s update using lyrics from his most famous song, Dream Weaver.

Though the dawn may be coming soon…Meet me on the other side

The yield curve is reflecting that we may be getting to the other side of the market downturn to the dawn of the new bull market. Friday’s closing yield on the 2 year Treasury was 4.97%. The yield curve while still inverted has begun to steepen., That is a positive development for stocks. Short-term rates are starting to fall back slightly as the end of Fed rate hikes grows closer. On the other end of the curve longer-term yields are moving higher on economic growth prospects. Why is it good for stocks? It reflects a growing economy that means rising corporate profits more earnings typically means higher stock prices. A meaningful steepening of the yield curve like what we are seeing also typically confirms the bottom of a bear market has occurred and we are at the beginning of a new bull market for stocks.

Dream weaver, I believe we can reach the morning light

Corporate CEOs are becoming more positive. In the wake of the recent uptick in many U.S. economic indicators, fewer corporate executives are talking about the prospect of a recession. The research firm FactSet searched conference call transcripts from the recently concluded quarterly earnings season and found that just 62 of the companies in the S&P 500 mentioned the term “recession.” That’s well below the 113 that mentioned the term in the previous quarter’s earnings conference calls, and down from 238 a year earlier. Positive chatter like the steepening yields doesn’t necessarily mean that an economic downturn is off the table but it should still be interpreted as a positive for stocks.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.