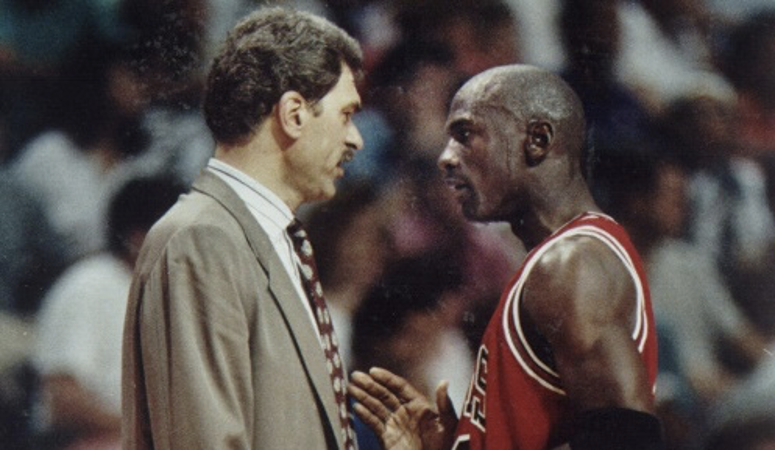

Hope all is well with you. Happy Rosh Hashanah to those of you who are celebrating, l’shana tovah u’metukah. The major U.S. stock indexes were little changed for the week, trading in a fairly narrow range. That’s in keeping with the market’s mostly flat profile over the summer; the gap between the S&P 500’s peak and low points since late June has been less than 5%. As today is legendary coach Phil Jackson’s 78th birthday I have broken down this week’s update using some of his famous quotes.

Wisdom is always an overmatch for strength

For month’s we have been able to keep the price of oil low in the US by flexing our strength and releasing oil from the strategic petroleum reserve. The problem is we don’t produce enough to meet our demand which means we need to import. The world’s oil producers know the US is going to eventually need more oil, and they have played the long game and been patient. The price of U.S. crude oil climbed for the third week in a row and eclipsed $90 per barrel on Thursday for the first time since last November. The price has climbed around 14% over the past three weeks. The main driver behind the recent surge has been production cuts from Saudi Arabia (the top oil exporter) and Russia, as both countries announced earlier this month that they will maintain the current lowered production through the end of the year.

Approach the game with no preset agendas and you’ll probably come away surprised at your overall efforts.

It’s easy to go in with the preset notion that rising inflation will hurt stocks. The main benchmark of U.S. inflation climbed at its fastest pace since mid-2022. The Consumer Price Index (CPI) rose at an annual rate of 3.7% in August and 0.6% on a month-to-month basis. Core inflation rose at a more modest 0.3% on a month-to-month basis. Let’s dive deeper into the numbers. Inflation on the surface appears to be going the wrong way, which would be a bad thing for stocks. However, the most recent data does NOT alter the disinflationary trend that has been established this year.

The cause behind the acceleration in both consumer and producer prices over the past two months is higher oil prices. Again, the market cares about how the Fed interprets the inflation reports. Core inflation which doesn’t consider food and energy matters more for Fed policy. The rise in core inflation was only slightly more than expected. The labor market is starting to cool a bit. That cooling will start to be reflected in the form of lower wage gains and slower growth in the housing sector, which in turn will lead to further drops in core inflation. I think the new bull market we are in still has a fertile ground on which to grow. Any pullbacks in stocks should be viewed as buying opportunities.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.