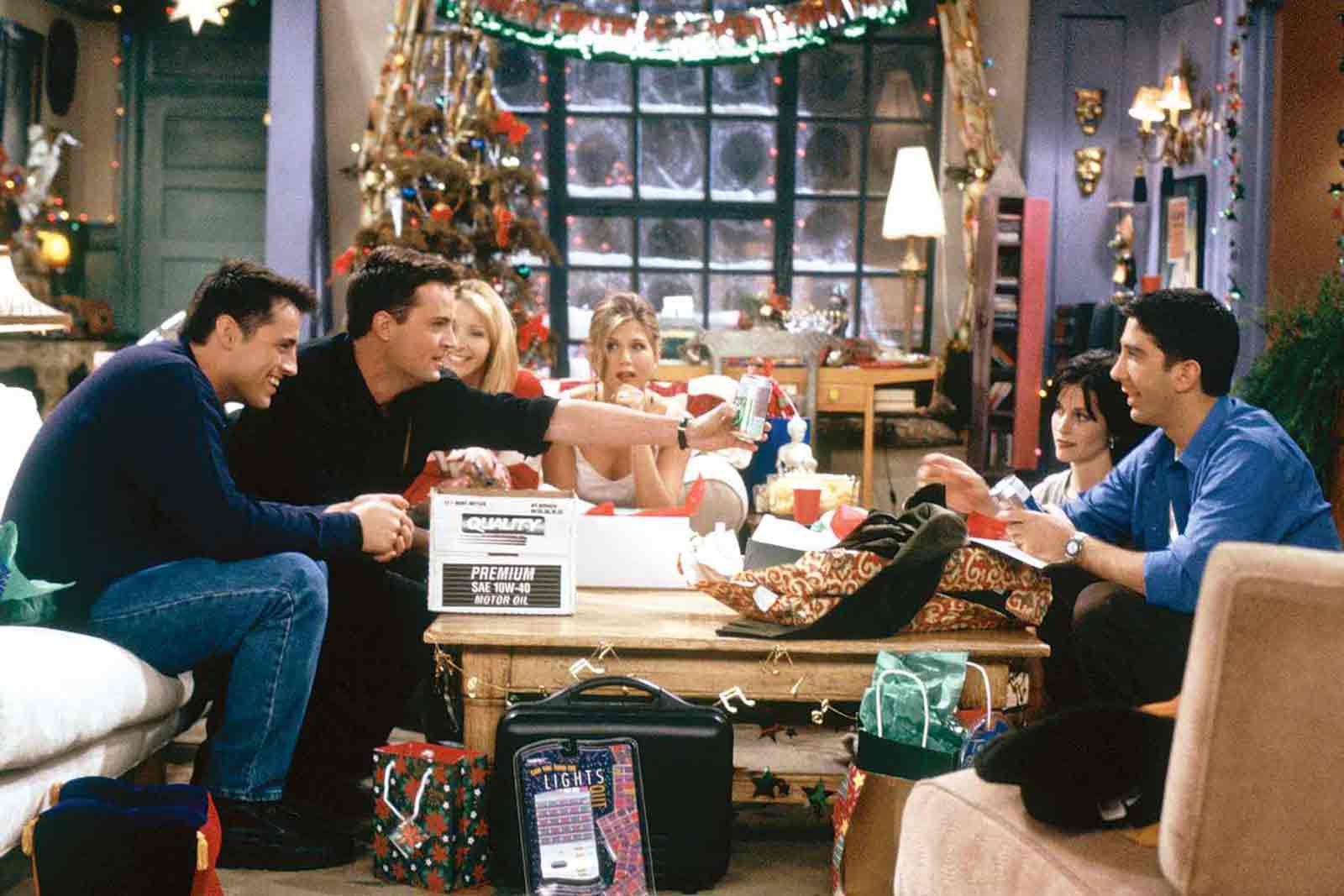

Hope you are all doing well. U.S. stock indexes posted their biggest weekly gains of 2023. The markets reversed course just a week after the S&P 500 and the NASDAQ entered correction territory following recent declines. The NASDAQ surged 6.6%, the S&P 500 added 5.9%, and the Dow rose 5.1%. Matthew Perry passed away this week. I have broken down this week’s update using one-liners from his most well known character, Chandler Bing on Friends.

Chairman Powell’s comments this week did not give any clear advice as to the direction of future moves. Yes, the U.S. Federal Reserve again kept interest rates unchanged, but rates are still at their highest level since 2001. Chair Powell left the door open to the possibility of approving another rate hike at the Fed’s mid-December meeting. The central bank has now held rates steady for two meetings in a row, marking the longest period without an increase since the Fed began to lift rates from a near-zero level in March 2022. The outlook for monetary policy remains the central driver for financial markets. The Fed holding rates steady at its meeting last week was expected. The Chairman’s comments struck a more balanced tone around the Fed’s outlook for upcoming rate decisions. The market move tells you that the comments support the view that the Fed rate-hiking cycle is complete. I remain unconvinced.

The jobs number missed expectations. Bad news on the employment front was good news for stocks. Stocks climbed following Friday’s jobs report, which showed a labor market cooldown. The market is trying to handicap what the U.S. Federal Reserve will do next. A weakening labor market makes the Fed less inclined to raise interest rates again in the short term. The jobs number was softer than expected but the labor market is still strong. In October, the economy generated 150,000 new jobs. Despite adding jobs the market is focusing on the number of additions which was about half as many as in September. It is also down from an average of 258,000 over the last 12 months. October’s unemployment rate edged upward to 3.9%. I remain cautious. The market has assumed the Fed is done. I continue to believe they could hike one more time. We have never had a recession start from below 4% unemployment. The economy is still adding jobs, so I feel the Fed still believes it has a runway if they want to hike one more time.

After pushing right up against 5% yields last week. Interest rates have found resistance falling back dramatically this week. The shift in U.S. interest-rate outlook triggered big weekly moves in the bond market. The yields of U.S. Treasuries fell, halting the trend of sharply rising yields that has been in place the past seven months. The yield of the 10-year U.S. Treasury bonds fell to 4.52% on Friday, down from 4.83% the previous week. The 10-year Treasury yield falling takes away what has been the main headwind for stocks. If we have stable rates through the end of the year that would be a positive for stocks. Rates staying somewhat consistent should provide for a stable bond market and allow stocks to surge higher to end the year.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.