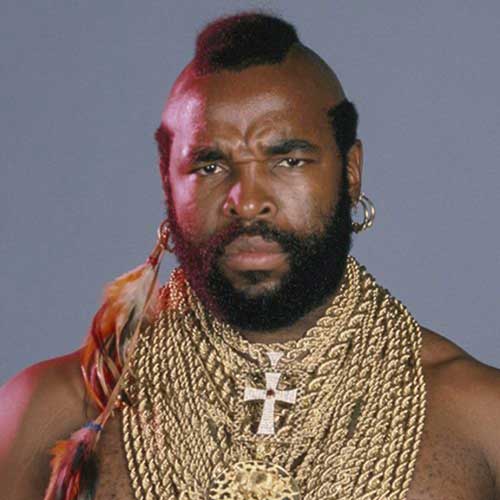

Hope all is well with you. Happy Veterans Day! Thank you to all of you who have served. U.S. stock indexes rose modestly, maintaining positive momentum after a rally in the previous week produced the biggest weekly gain so far in 2023. In the latest week, the NASDAQ added more than 2%, the S&P 500 rose more than 1%, and the Dow finished with a fractional gain. In honor of Veterans Day, I have broken down this week’s update using quotes from Army veteran, Pvt. Laurence Tureaud, aka Mr. T.

Mr. T’s golden rule was correct in October, not so much this month. The price of gold and precious metals spikes when there is uncertainty, fear and geopolitical shocks. That is why it wasn’t surprising that gold spiked in October getting all the way to almost $2,037 an ounce. Once the fear subsides gold tends to meander back down which is what we are seeing now. Gold is now at $1,938.40 an ounce. Long term gold is not a worthwhile investment, there are no dividends and the price moves in short bursts, if you don’t sell when it’s bursting higher you could go years with little to no return. For example gold was worth $1,837.68 an ounce at its peak in July of 2011, it took 9 years and global pandemic for it to make a new high in July of 2020.

In 2022 it would have been easy for crypto investors to just throw in the towel. The price of Bitcoin peaked in November of 2021 at 65,000 a coin. Bitcoin, the most widely traded cryptocurrency, had dropped close to 75% in value by the end of 2022. This week it jumped to the highest level since May 2022. Bitcoin was trading above $37,000 on Friday. Bitcoin owner’s who stuck it out through 2022 have benefitted this year. Friday’s price was more than double Bitcoin’s year-end 2022 level of less than $17,000.

U.S. consumers are showing signs of being stressed. Consumer sentiment was on the decline for the fourth month in a row. October’s reading of sentiment reveals concerns about high interest rates and escalating conflict in the Middle East. The University of Michigan’s preliminary reading on consumer sentiment also showed that consumers’ short-term inflation expectations rose to the highest level in seven months. Remember that the price at the pump has a large effect on consumer sentiment. I expect November’s sentiment reading to be better because the price of oil is now at its lowest level since mid-July. On Friday, U.S. crude was trading for around $77 per barrel, down from about $89 three weeks earlier.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso by clicking the calendar link below and schedule a phone or zoom appointment at any time.