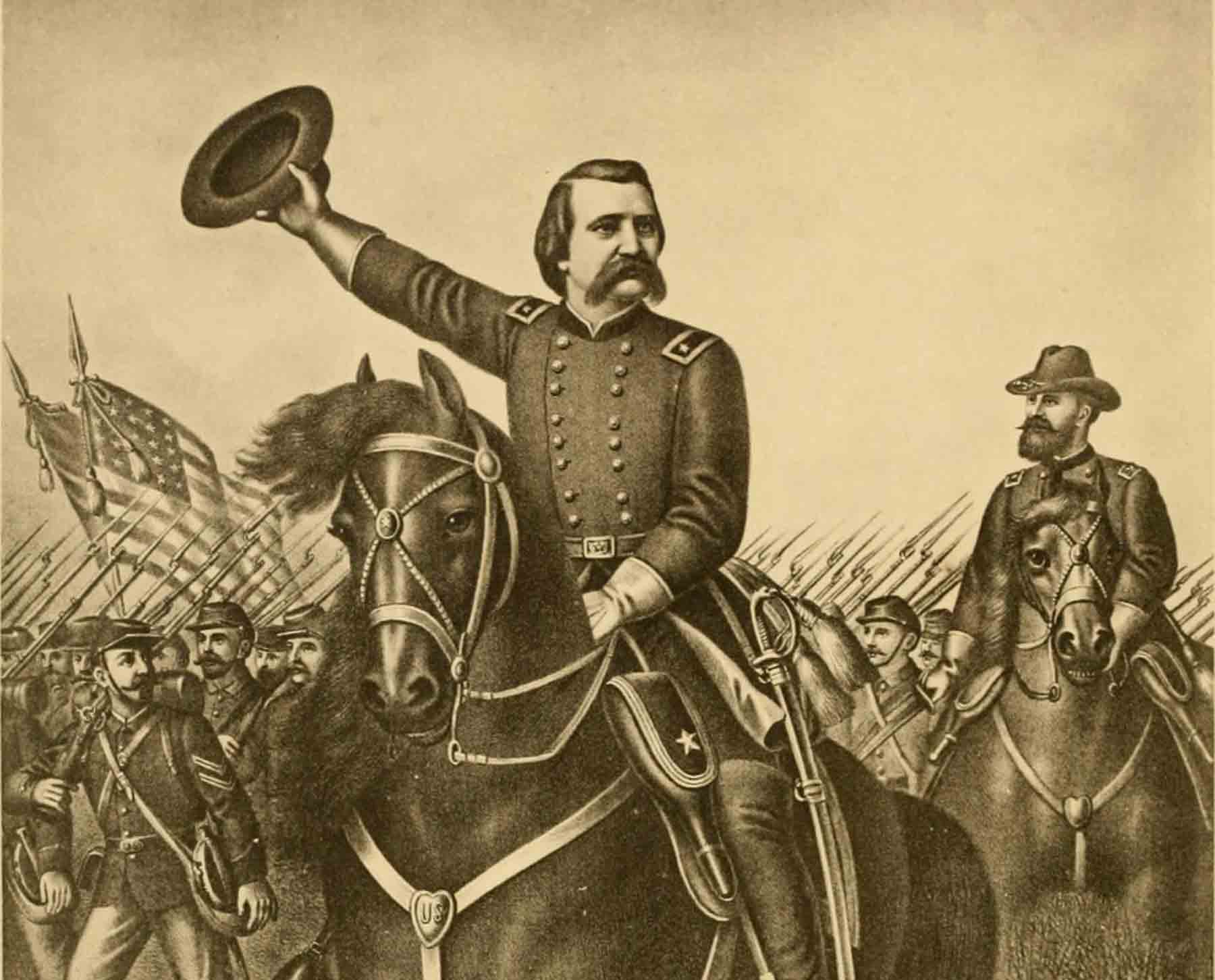

Hope you are all doing well. Happy Memorial Day! Stocks were basically flat this past week. The Dow lost 1% while the S&P eked out 0.3% return for the week. The Nasdaq continues to outperform gaining another 2.5% on the week and is now up 24% year to date. The Nasdaq is tech heavy; the one sector that stood out this week was informational technology led by Nvidia. The sector was up over 4.0% for the week. In fact, the technology sector is one of just three sectors in the S&P 500 Index that is positive year-to-date, along with consumer discretionary and communication services. Technology and communication services are now up over 30% this year already, and firmly in bull-market territory. Meanwhile, each of the other eight S&P 500 sectors are negative this year. I have broken down this week’s update using quotes from General John A. Logan, who is credited with starting Memorial Day in 1868 and for whom Logan Circle in DC is named.

It seems Democrats and Republicans are going to put their divisions aside and actually get a deal done. As of last night a deal to extend the debt ceiling for two years seems imminent. A tentative deal is taking shape ahead of the June 5 (X-date). June 5 is the date Treasury Secretary Yellen says we will run out of funds. Here’s what we know about the potential deal: it would increase the debt ceiling and cap on federal spending for two years. It includes a potential 3% rise in defense spending next year. It also includes a measure to upgrade the nation’s electric grid and permits are granted for pipelines and other fossil-fuel projects. The big concession and the last sticking point is on rescinding some of the $80 billion allocated for the Internal Revenue Service as part of the Biden administration’s Inflation Reduction Act. Congress has vowed to work through the long holiday weekend to continue to push toward a deal, hopefully an agreement is announced prior to Tuesday’s market open. If it isn’t, expect the markets to be volatile next week. Last week, the Fitch rating agency put the U.S. AAA credit rating on watch for a potential downgrade. If we don’t have a deal after this weekend, look for the other credit rating agency to make a similar designation. Fitch did however note that they believe a deal will get before the X-date.

Music is the medicine of the mind.

Lower interest rates are the medicine to ease the market’s mind but we may need to wait a little while longer before that happens. Once we get a debt ceiling deal done the market will turn its attention to the Federal Reserve meeting in mid June. As I have been saying for weeks, the Fed is likely not done with the rate hikes, even though the market is expecting them to pause. Several Fed officials have indicated that the Fed’s focus remains squarely on fighting inflation, which remains too elevated for comfort. Headline inflation has been dropping but that is not the Fed’s preferred gauge. The PCE (personal consumption expenditures price index) inflation data is the number Fed officials pay most attention to. We got another read on the PCE Friday, and it moved higher. Services inflation remains persistent, driven by a solid labor market and still-elevated wage growth. With a strong labor market and the economy still staying above water the Fed still has a runway for further rate hikes. In fact, markets are now also starting to agree with my take. As the probability of one additional rate hike by the Fed, has increased significantly in the past week.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time. Enjoy the holiday weekend!