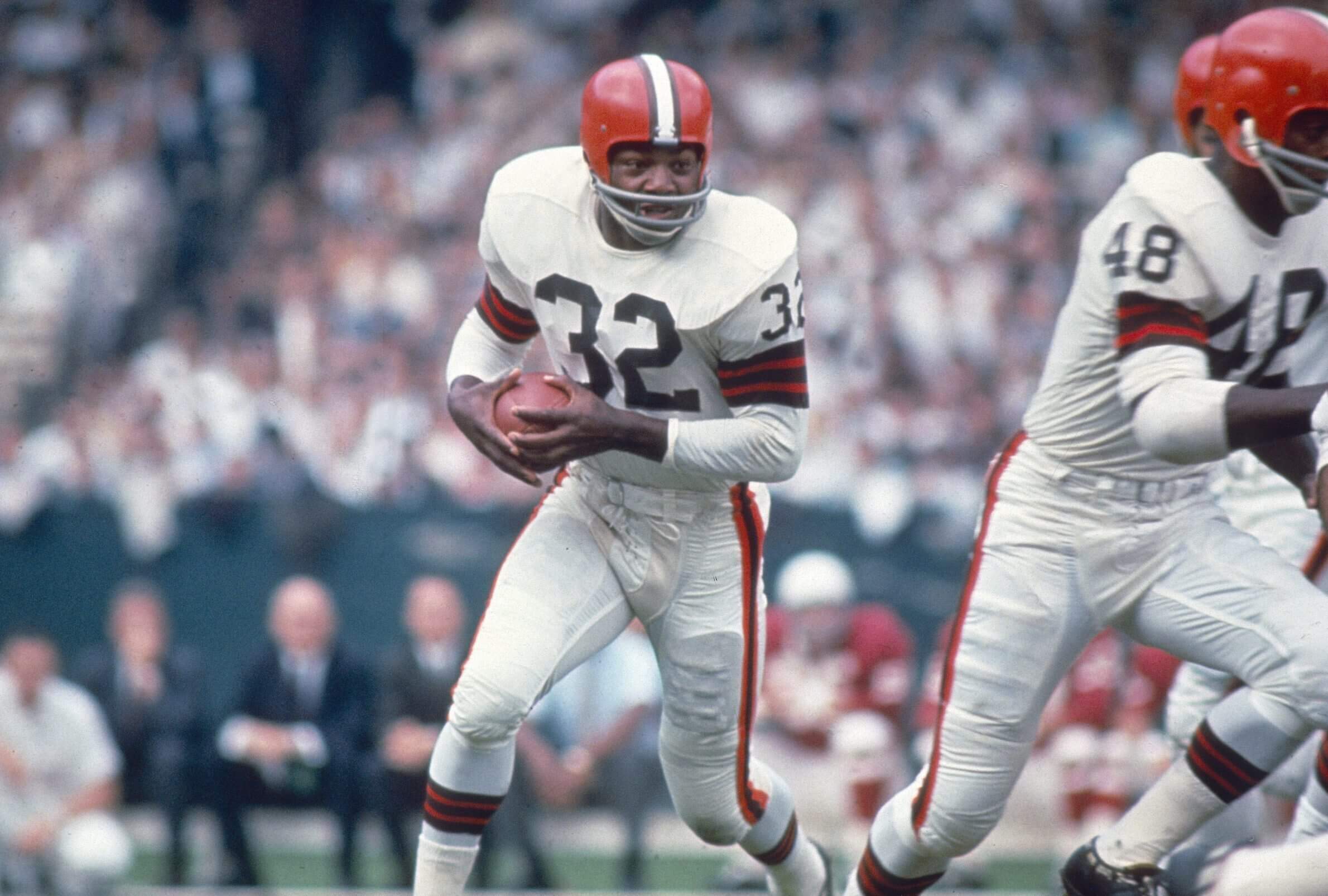

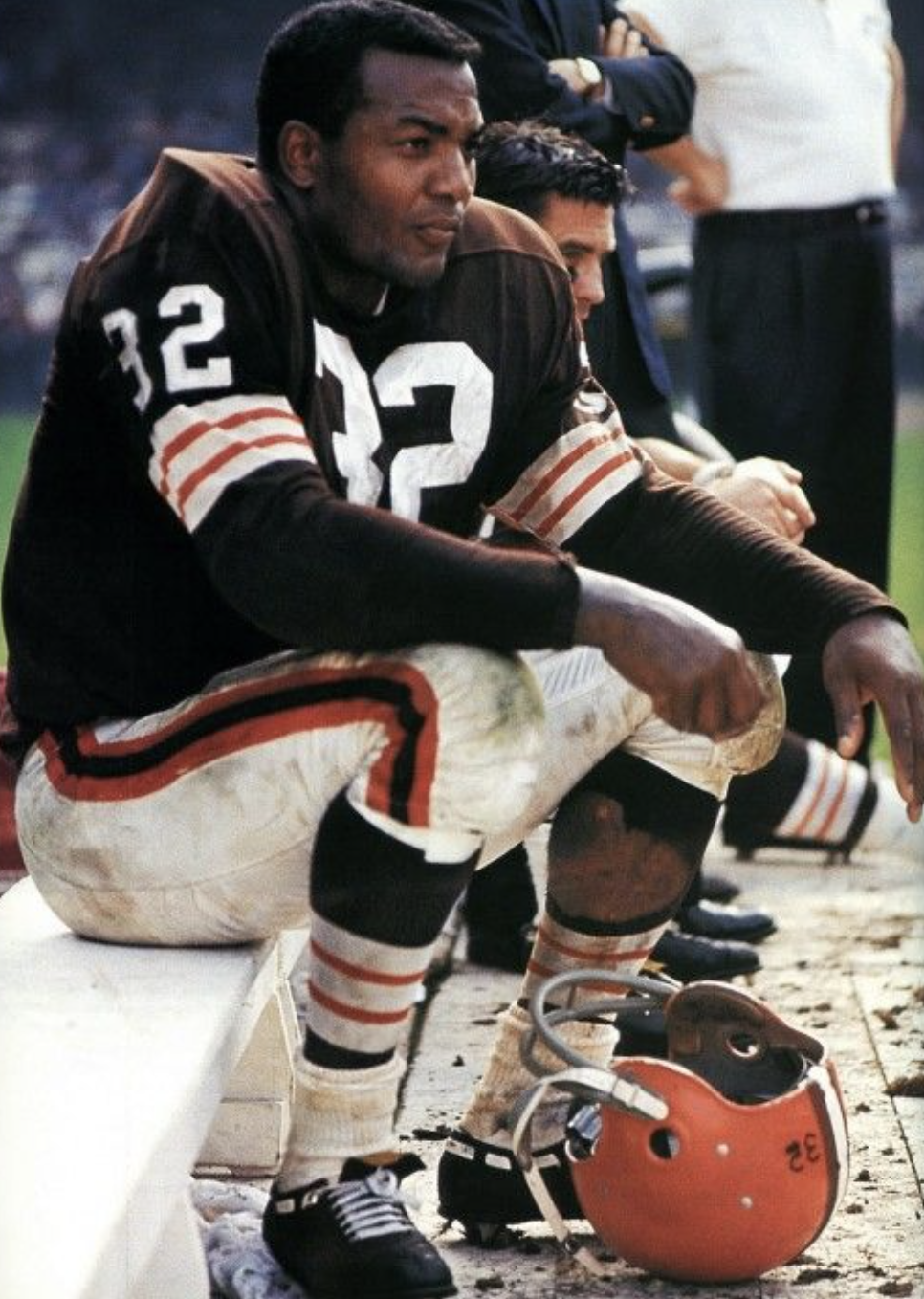

The markets had a strong week with all three indexes posting positive returns. The Nasdaq led the way gaining over 3 % on the week and is now up over 20% since the beginning of the year. Jim Brown passed away this week, I have broken down this week’s update using quotes from the legendary running back, actor, and civil rights activist.

The debt ceiling negotiations seem to be stalling. Over the next two weeks markets will behave erratically. We are going to get a lot of opinions about how to react to every ebb and flow of the debt ceiling debate. Tune out the noise and stick with your plan. Emotions can lead to irrational decision making and impulsive decisions that compromise the realization of your goals. When there is fear and uncertainty in the air, the scary news makes you question what you should do. The stock market is likely in the tail end of this bear market and a deal will get done before the country defaults just like has happened every other time an increase in the debt ceiling has been needed. If we have a string of bad days because of the headlines out of Washington then stick with the principals that investors like Warren Buffet follow, buy and hold don’t make knee jerk reactions.

Fraying U.S.-China relations and rising tensions over Taiwan have influential business leaders such as Elon Musk and Warren Buffett sounding alarms about a possible invasion. This figures to be a central issue in the 2024 election. Now is the time for world leaders to show unity and strength. Taiwan will be a topic of discussion during this week’s Group of Seven (G7) meeting in Japan, which President Joe Biden is attending. China is an adversary in every sense and will continue to challenge us on a range of issues like foreign policy and trade. Their recent activity in the Taiwan Straits could lead to a military conflict at some point. That’s why it’s important for the G7 to show China and other would-be invaders that they are united and ready to defend against unprovoked attacks. To the President’s credit the US has armed Taiwan with everything from air defense systems to anti-ship missiles to fighter jets. It will help if the other G7 leaders step up as well.

A recession is looming but should not be as bad as the market is expecting. Corporations have been prepping for the slowdown and proactively making adjustments like the layoffs we saw at the big tech firms. As a result, we continue to see earnings reports that are beating expectations. This week was no exception. Some of the biggest retailers in the country Target, Walmart, and Home Depot reported earnings that beat expectations. Target and Walmart are a good gauge of the overall health of the US consumer. They both spoke about sales trends across the country getting worse. As the three-month period went on, shoppers spent less, especially on discretionary merchandise. Both big-box retailers reported a sharp sales drop after February. Last year the market priced in a major economic slowdown this year which has yet to materialize. The slowdown is coming according to the CEO’s of both companies but this is not a new message. The key is when you look at their results they continue to beat expectations. Which tells you the economy continues to be better than expected.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.