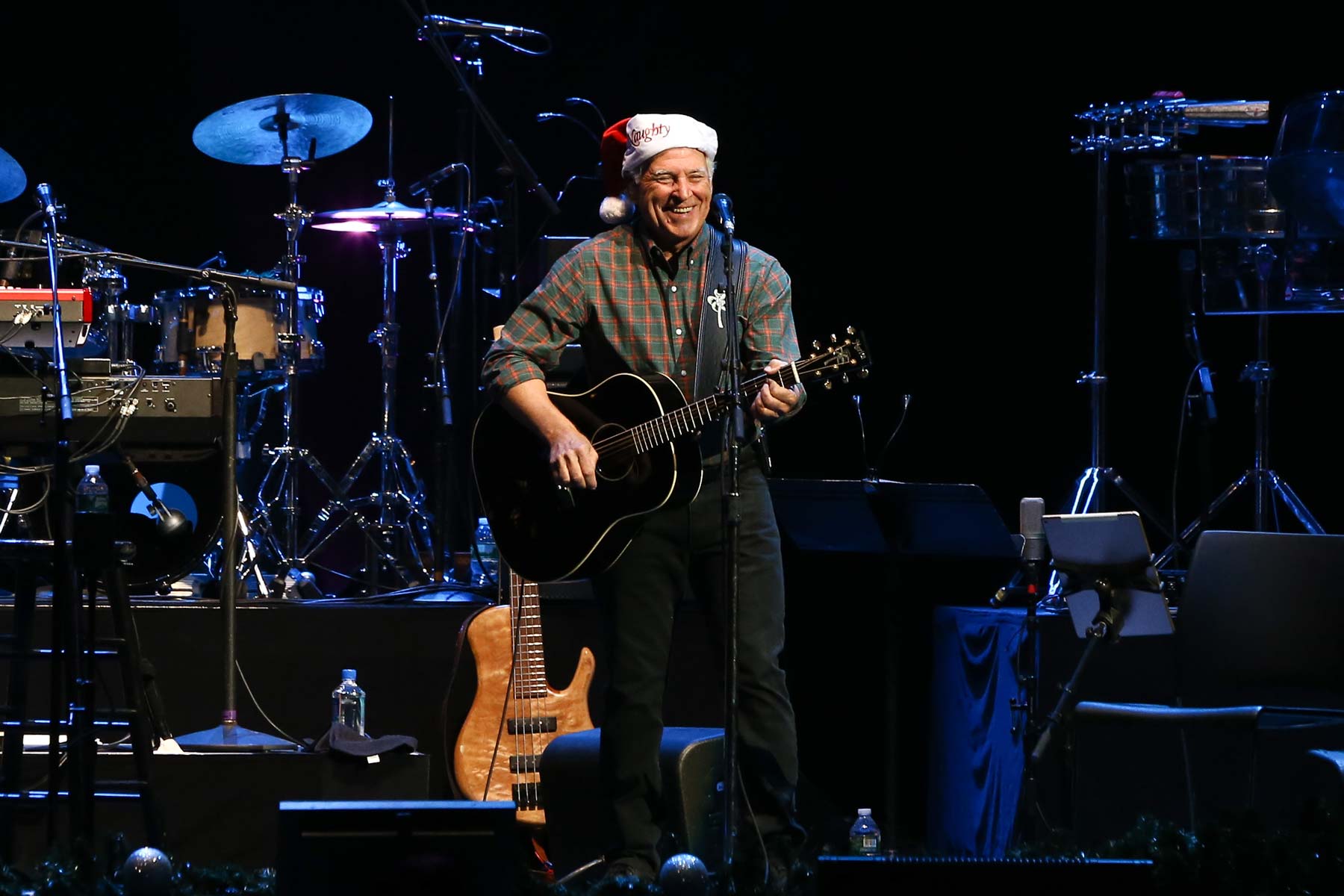

Hope you are all doing well. As war broke out between Russia and Ukraine, the week ended up modestly positive overall for the S&P 500 and the NASDAQ, with the Dow essentially flat. As I predicted in my email Wednesday evening, Thursday was a very volatile day for stocks falling sharply on Thursday morning as Russia began its invasion. In the afternoon and on Friday stocks made a huge turnaround, just as it has in past crisis situations. Cooler heads prevailed in the market as countries imposed increasingly stiff economic sanctions against Russia. Many of you are anxious about the market. To help get you to a cooler mindset, I have broken down this week’s news using Jimmy Buffett songs and lyrics.

Let me be clear when I quote the song and say it will be alright, I mean the stock market. The images of war are jarring, and conflict forever changes the lives of those involved. I am not downplaying the war. However, the direct impact on the U.S. economy and corporate earnings is limited. Trade between the U.S. and Russia is relatively insignificant, and Russia’s economy is only the 11th largest, accounting for less than 2% of the global economy. For perspective, the German economy is almost three times larger, despite having half the population.

We had a terrific run up in stocks off the lows of March of 2020. It is natural to start viewing every piece of bad news or down draft as the end of the good run. That is what we saw Thursday morning when investors’ expectations of short-term stock volatility soared about 22% to the highest level in a month. Negative sentiment has been persistent all year. It is usually a contrarian indicator meaning it is typically the best time to invest when people are the most negative. An investor sentiment survey released this week showed that investors appear overly pessimistic which historically has translated into above-average three-month returns. Sentiment is now worse than it was during the height of the pandemic. For perspective, the last four times this indicator has flashed as overly pessimistic the market has been higher three months later.

My calendar link is below. If you haven’t scheduled a review or you just want to have a quick call to discuss your investments please use the link and schedule a time.