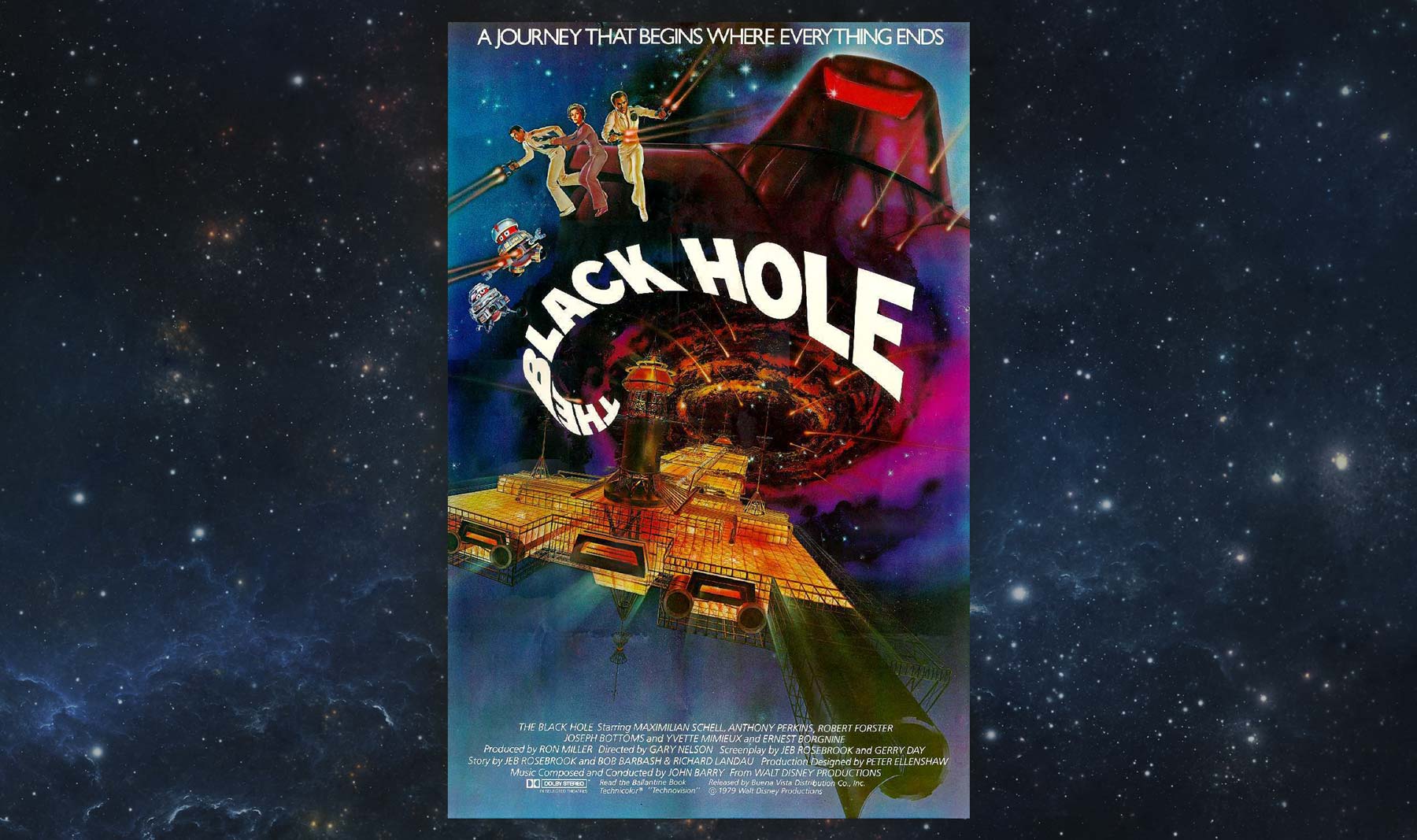

Hope all is well. Happy Passover and Easter! It was a mixed week for stocks as the Dow rose slightly while the S&P and Nasdaq were both down for the week. Despite the down week both indexes are up significantly on the year. In case you missed it this week, a runaway supermassive black hole was spotted by the Hubble Telescope. I have broken down this week’s update using quotes from Disney’s failed attempt to cash in on the popularity of Star Wars, 1979’s The Black Hole.

I believe the ingredients necessary for a mild recession are starting to form. As I have mentioned before it is important to remember that the market cycle and economic cycle are distinct and markets are a leading indicator. That means markets are often months ahead of the economy. So just as the market went down while the economy was still good, it is possible the market could rebound even while the economy is bad. As markets start to recover, I would expect the leaders from the previous bull market to take back over the leadership position . We are seeing that with the recent run up in Apple stock, eventually leadership will become more balanced with things like small caps, international and cyclical stocks rallying. I am optimistic about the second half of this year, but we are not there yet. A wolf remains wolf, the deteriorating economy will still put downward pressure on stocks over the next few months and we may give back some or all of the gains we have made this year. We saw the early signs of recession this week. Manufacturing is slowing. The ISM manufacturing index, a gauge of manufacturing health, fell to a near three-year low to 46.3, below expectations of 47.5. Readings below 50 indicate a contraction in activity. Even the service sector while not contracting is slowing. The ISM services index came in at 51.2, well below expectations. We still have record low unemployment but the jobs data released this week showed wage growth is slowing which could cause consumers to reign in their spending in the coming months.

Headlines are emerging about countries including Brazil, Russia, India, China seeking to create a competing currency and calling for de-dollarization. This would create competition for the dollar particularly in oil and commodity trading. Many of you have asked me this week about my opinion on the U.S. dollar and whether it will remain the world’s reserve currency. I won’t go as far as to say the collapse of the dollar is impossible, it is extraordinarily unlikely. Here’s why. The U.S. dollar still dominates foreign-exchange reserves, which are the assets held by global central banks in foreign currencies. The percent of reserves held in U.S. dollars has moderated as competing currencies (most notably the Euro) have emerged over the past 50 years. However, the dollar remains far and away the most held currency, comprising nearly 60% of global reserves.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.