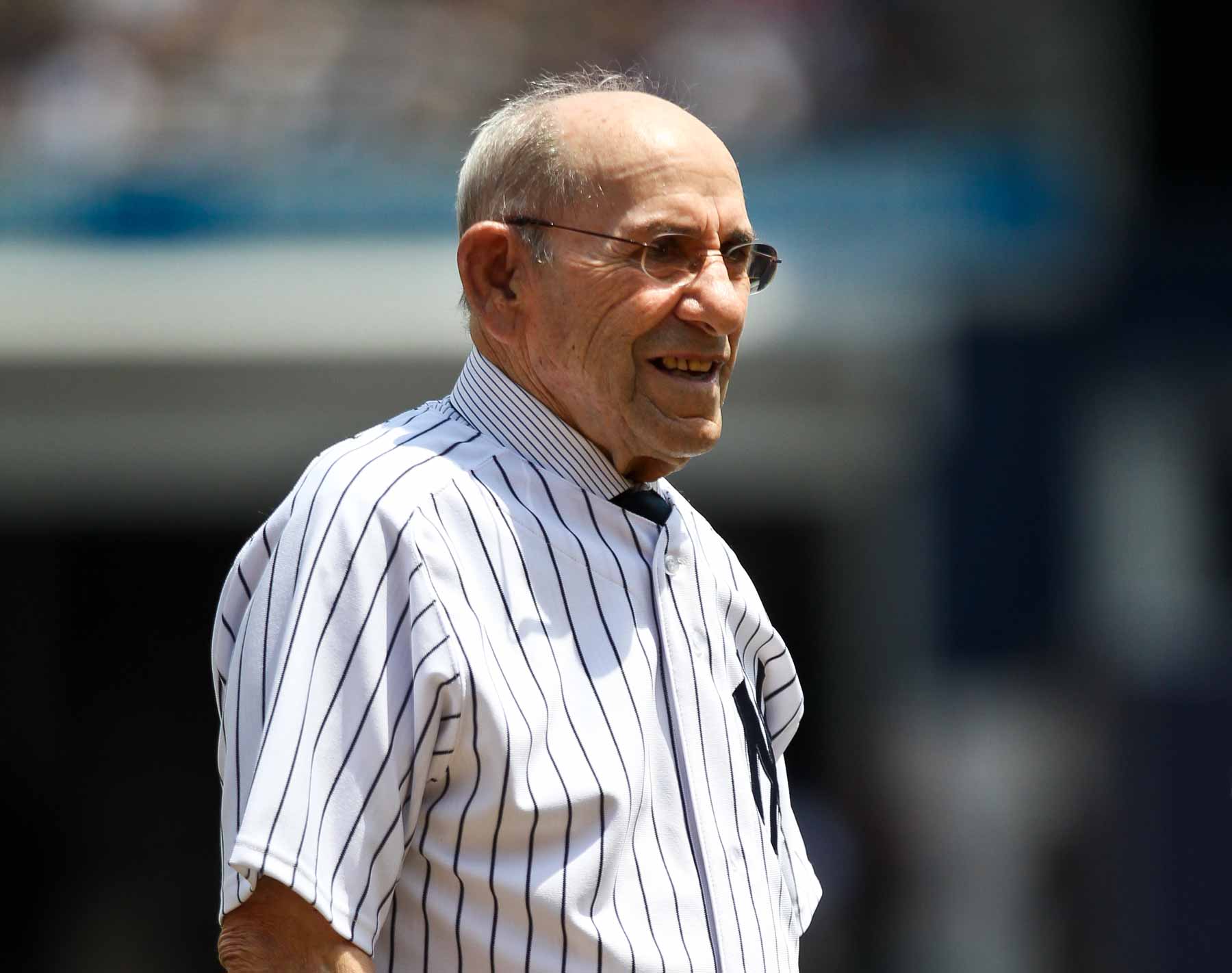

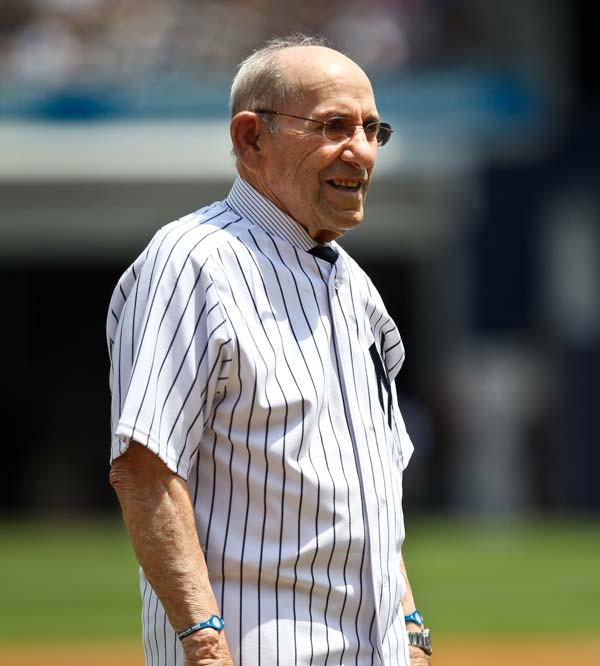

Hope all is well. The S&P 500 and the NASDAQ added more than 3%, climbing for the third consecutive week and recovering more of the ground lost in a difficult February. The Dow also gained more than 3%, rising for the second week in a row. The baseball season opened this week, so I have broken down this week’s update using quotes from baseball’s most quoted player, Yogi Berra.

The market leadership is shifting back to a familiar leader, tech stocks. Tech stocks led the market for most of the previous bull market and their return to leadership position could be a positive sign of things to come. The S&P 500 managed to eke out a small gain in March. Even after a 15% drop in large banks and a 22% drop in regional banks. The gain highlights the tug-of-war between the tech-heavy Nasdaq which logged its best quarter since 2020 and the Dow. The NASDAQ posted a 17.0% quarterly total return as tech stocks rallied. Those same stocks helped the S&P 500 add 7.5%. While the Dow was up only 0.9%. The NASDAQ is now 22% from its December lows putting it in bull market territory. We are not out of the woods yet. A mild recession is likely to take shape this year. However, given the strength in the labor market and consumer finances I still don’t believe it will be a deep or prolonged downturn.

Inflation has been the biggest concern for consumers and markets for the last two years but expectations are starting to become more optimistic. The University of Michigan said its survey indicated that while a growing number of consumers expect a recession is ahead, their near-term views of inflation have moderated. The numbers support this view. A report released on Friday showed that the U.S. Federal Reserve’s preferred gauge for tracking inflation rose 0.3% from January to February, down sharply from the 0.6% rate in the previous monthly update. On an annual basis, the Personal Consumption Expenditures Price Index rose 5.0%, down from the prior month’s 5.3% figure. It’s not just in the US that the numbers are improving. Inflation in the Eurozone (the 20 countries that use the euro currency) slowed to the lowest level in 12 months as energy costs moderated. The European Union said overall consumer prices rose 6.9% on an annual basis in March, down from 8.5% in February. Eurozone inflation has been easing since peaking at 10.6% last October.

This interest rate cycle has reached a fork in the road while yields may climb a little like they did this week, they have likely peaked. U.S. government bond yields rose and snapped a string of three consecutive weekly declines. The yield of the 10-year U.S. Treasury bond rose to about 3.49% on Friday. That is up from 3.38% at the end of the previous week. However it is still down sharply from a recent peak of 4.07% on March 2. I think yields stay pretty close to where they are now and that the March 2nd peak holds. Historically, 10-year Treasury yields have peaked about two months before the last Fed hike, which would be consistent with my view that the Fed has one or two more hikes left. Both economic growth and inflation should slow which will keep yields from spiking and keep bond prices a little more stable than they have been.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.