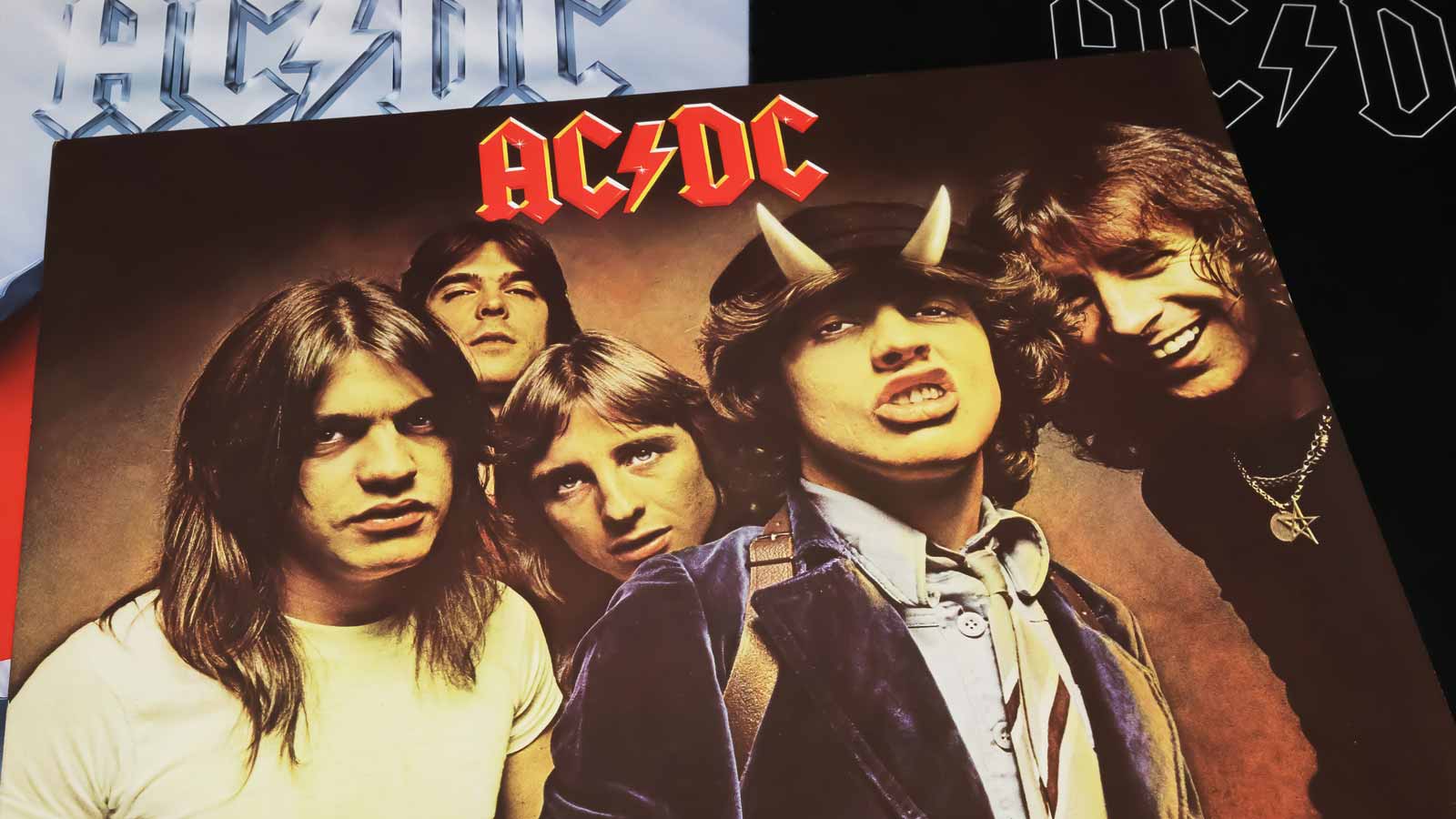

Hope you are all doing well. Markets got off to a shaky start to the week and the second quarter. Strong economic readings raised concerns about if and when the Fed will be able to start cutting rates. The market is coming to the realization that an initial interest-rate cut could be delayed into the latter half of this year. The major indexes dropped more than 1% on Thursday, and a partial recovery on Friday didn’t prevent stocks from posting weekly declines. Earthquakes dominated the headlines this week, so I have broken down this week’s update using lyrics from AC/DC’s Shake Your Foundations.

No one can stop us ’cause we’re feelin’ too right.

The labor market continues to feel right. Despite high interest rates, the job market is not cooling. March’s jobs gain of 303,000 exceeded economists’ expectations for around 205,000. The latest figure was the biggest in 10 months, matching the 303,000 jobs added in May 2023. The unemployment rate slipped to 3.8% from 3.9% the previous month. March’s payroll report shows that employment conditions remain healthy. The extreme tightness in the labor market that has driven consumer spending and GDP growth for the last few years. It may soften at some point but it is unlikely to fall off a cliff because our country has 10,000 people turning 65 each day, and many are retiring and exiting the workforce. Somebody has to fill those jobs. This should keep the labor market strong for the foreseeable future. Even the hospitality sector continued with its job gains and now total employment in the sector is back to where it was before the pandemic.

I was takin’ no liberties.

Central Banks have been taking no liberties and showing ample respect to the danger inflation poses. As a result, markets are starting to realize interest rates are going to be higher for longer. The good news is inflation is not just headed in the right direction here in the US it is also improving in Europe. The 20 nations that use the euro currency reported a steeper-than-expected decline in inflation, with consumer prices rising at an annual rate of 2.4% in March versus 2.6% in the previous month. While the eurozone’s inflation rate has steadily declined this year, the European Central Bank isn’t expected to begin cutting interest rates until June at the earliest.

Reminder to my Federal Employee clients. Laurel Wealth Solutions is sponsoring the upcoming Federal Executive Forum, June 12th in Washington D.C.. The link is below. If you are interested in attending, my clients will receive a 20% discount on their registration fee using the discount code LWS20.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso directly by clicking the calendar link below and schedule a phone or zoom appointment at any time. Effective May 1st in person appointments outside of the office or normal business hours will carry an additional fee of $75.