Hope all is well with you and that you are having a nice holiday weekend. The S&P 500 and the Dow both finished at record-high closing levels in a holiday-shortened trading week that concluded on Thursday, prior to a Friday report on inflation. The S&P 500 and the Dow both posted fractional weekly gains while the NASDAQ slipped. March marked the fifth positive month in a row for the major U.S. stock indexes, and the S&P 500 posted its strongest first-quarter result since 2019. That index climbed 10.2% for the quarter, the NASDAQ added 9.1%, and the Dow rose 5.6%. Over five months, the S&P 500 has surged 25.3%.

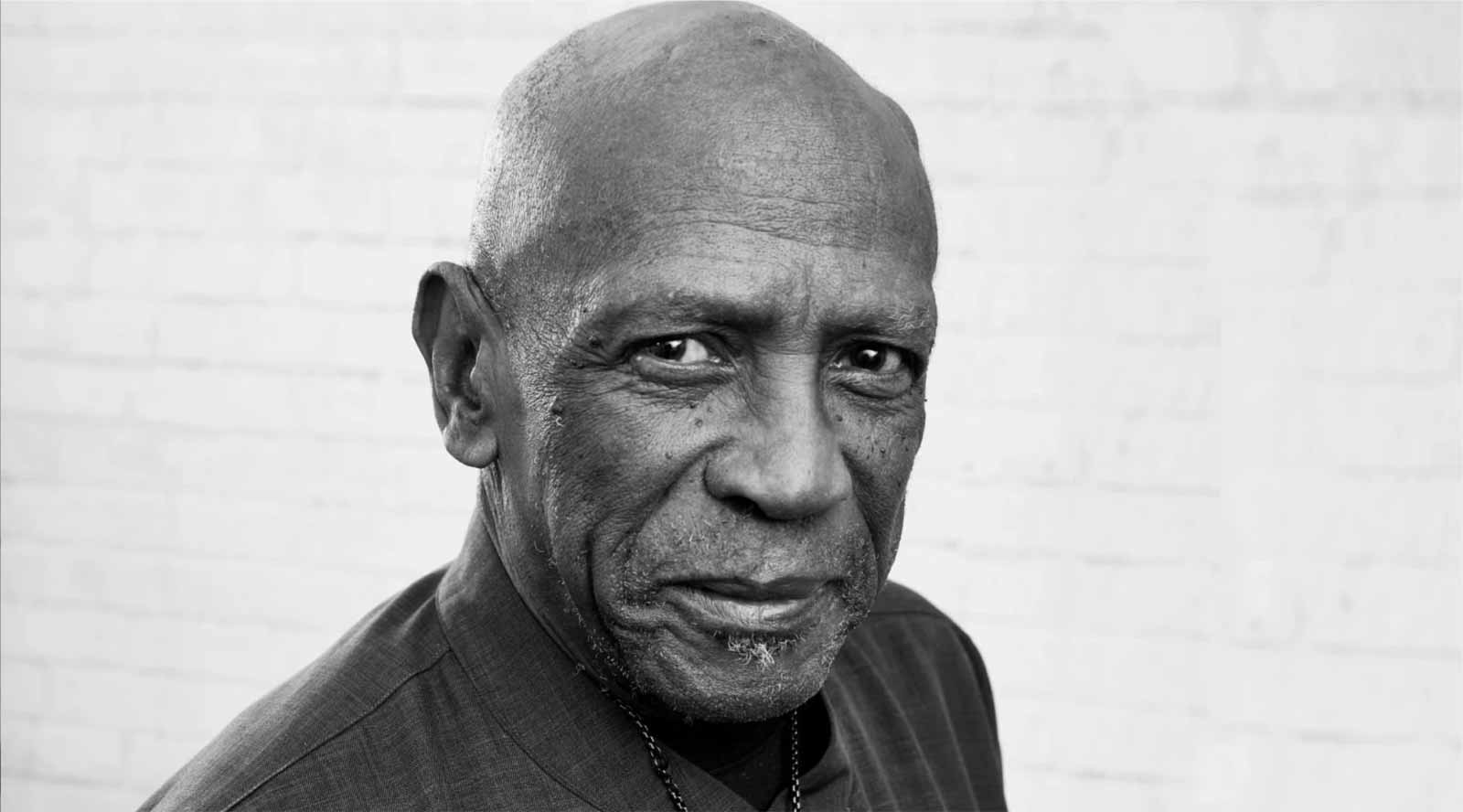

With a quarter of 2024 on the books, if you have not met with me yet this year please use the calendar link at the bottom of this email to schedule a review. Louis Gossett Jr. passed away this week, I have broken down this week’s update using quotes from his Oscar winning role as Drill Sergeant Foley in my wife’s favorite movie, Officer and a Gentleman

“Wave good-bye to your buddies, Mayonnaise! Oh, I forgot. You don’t have any buddies, do you?” – Louis Gossett Jr.

Inflation is heading away. The Fed’s steady course of rate hikes seems to have whipped it into shape. Friday’s reading from the Federal Reserve’s preferred gauge for tracking inflation showed that consumer prices rose at a much slower pace than they had been a few months earlier. The Personal Consumption Expenditures Price Index rose at a 2.8% annual rate in February, excluding food and energy prices. That result was unchanged from the previous month’s figure, which was the slowest increase since March 2021. We are getting closer and closer to the Fed’s target of 2% which is important because 2% percent is the level I feel most Fed officials would like to see before starting to cut rates.

“Gonna give you more than you can take; I’m gonna watch you crumble and watch you break!” – Louis Gossett Jr.

So much for the rate hikes breaking the U.S. consumer and causing a recession. The economy made it through. In fact, this week we got revised economic figures that showed a boost from consumer spending. This prompted the government to adjust its final estimate of fourth-quarter economic growth. GDP rose at a 3.4% annual rate, up from an earlier estimate of 3.2%. We did not get the recession in 2023 that was forecasted by many of the talking heads on television for all of 2022. In fact quite the opposite has occurred as the results marked the sixth quarter in a row that the annual growth rate has exceeded 2.0%.

“Only TWO THINGS come outta Oklahoma…” – Louis Gossett Jr.

It seems Sergeant Foley forgot that oil also comes out of Oklahoma. While he wasn’t referring to oil. Oil and gold were two assets that posted solid weekly gains, extending a run of recently strong results for both commodities. Gold spot prices on Friday were around $2,230 per ounce, a record high. U.S. crude oil was trading around $83 per barrel, up from around $81 at the end of the previous week and around $71 at the start of 2024.

Reminder to my Federal Employee clients. Laurel Wealth Solutions is sponsoring the upcoming Federal Executive Forum, June 12th in Washington D.C.. The link is below. If you are interested in attending, my clients will receive a 20% discount on their registration fee using the discount code LWS20.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso directly by clicking the calendar link below and schedule a phone or zoom appointment at any time. Effective May 1st in person appointments outside of the office or normal business hours will carry an additional fee of $75.