Market Breakdown for the week.

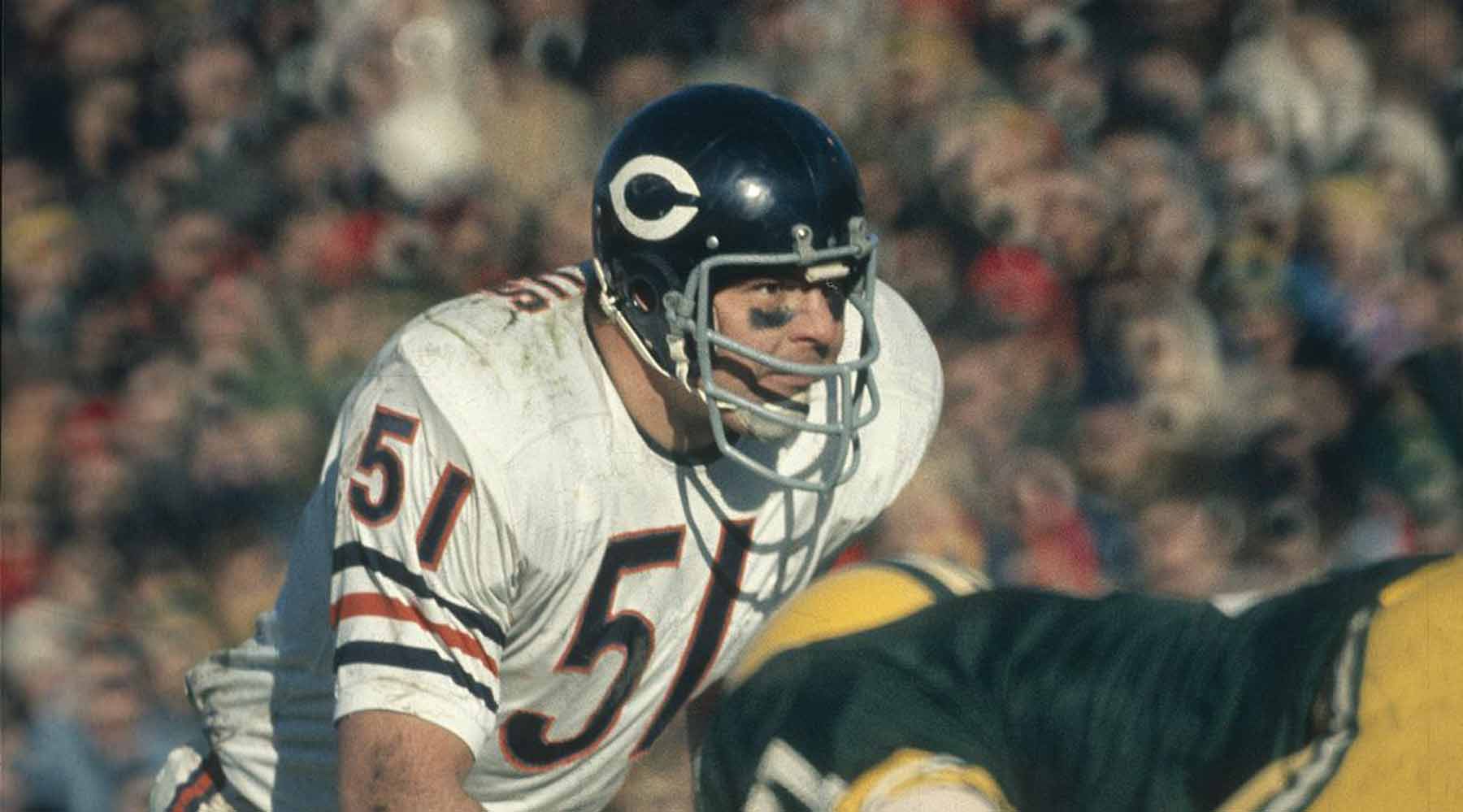

Hope all is well with you. The S&P 500 ended another volatile week up 0.48%, breaking a four-week negative streak. The Nasdaq also notched a positive week, climbing 1.60%. Meanwhile, the Dow closed down 0.30% for the week. The NFL lost a legend this week as Dick Butkus passed away. I have broken down this week’s update using quotes from the legendary linebacker.

Anything that happens that’s good, they think, Oh, it’s an accident, when is the roof caving in? You’ve got to get them out of that mental framework.

The surge in bond yields has been in complete control of market moves recently with rates rising and stocks pulling back. For most of the week, it has been a Good News = Bad News scenario for stocks. Strong economic data spurred worries over upcoming Fed decisions. Investors are worried the strong economic growth will start to cave if the Fed continues raising rates. Don’t get sucked into this narrative. I continue to expect falling core inflation and more economic growth albeit at a slower pace. I still see one more rate increase before we reach the end of the Fed’s hiking campaign. I don’t see the Fed dropping rates in 2024. That’s because I don’t see the labor market deteriorating to a point where they would abandon the fight against inflation to focus on rising unemployment. However, I don’t think that’s a bad thing for stocks because I believe the US consumer will stay strong. Unemployment is still extraordinarily low by historical standards and if people are working and inflation is moderating US consumers will continue to spend. Consumer spending comprises roughly two-thirds of GDP which is how we measure the economy.

Funny the orange juice just tastes a little bit sweeter this morning.

September’s jobs came in better than expected and had the White House taking victory lap on Friday. The report showed that the labor market still has some fight in it. The economy added 336,000 jobs in September. Payroll growth far exceeded expectations and accelerated from the pace of the last few months. Initially rates jumped and stocks dipped in response. Later in the day as the market digested the report stocks rallied as investors focused on wage growth which continued to moderate. Wage growth is a key driver of inflation, and the deceleration of wage growth supports my prediction that core inflation will continue to moderate.

My thing is trying to convince them they can win.

Well maybe, Dick Butkus convinced Matt Gaetz he could win and now for the first time ever, a House speaker has been voted out of the position. An essential body of American democracy no longer has an elected leader, it is certainly not something I expected to happen. However, turmoil in Congress can actually be a good thing for markets. Historically, gridlock has been good for stocks. Since 1928, the S&P 500 Index has delivered average annual returns in the double digits during years when Democrats and Republicans shared control of Congress as they currently do. The ousting of the speaker just adds to the gridlock, so it is not a reason to sell stocks. We hit the one-year anniversary of 2022’s bear-market low. The speaker-less House is among multitude factors still at play in the stock market. History shows that one-year-old bull markets tend to keep growing. Since 1974 when market recoveries reached the one-year mark from the cyclical low, in all 8 instances, stocks did go back and revisit the prior bear market lows. I continue to believe that the sell off from the July highs is a normal pullback and expect the market to rally as we start the next leg of this bull market.

Contact Lauren Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso by clicking the calendar link below and schedule a phone or zoom appointment at any time.

Visit our Services page for more information on how we can help you execute a reliable retirement income plan.