Hope you are all doing well. It was a down week for markets. The S&P 500 fell more than 3% and the NASDAQ dropped nearly 6%, failing to maintain their positive momentum from the previous two weeks. The Dow’s relatively modest setback of roughly 1% snapped a four-week winning streak for that index. With the midterm election just around the corner, I have broken down this week’s update using famous campaign slogans.

The Federal Reserve was in focus again this week as the US Central raised rates another 75 basis points. The fact that the economy is still showing signs of growth gives the Fed some wiggle room for continued rate hikes. Wednesday’s move takes rates to their highest level since 2008. It is the fourth consecutive three-quarter percent interest rate increase bringing rates up to a target range of 3.75%-4%, the highest level since January 2008. The pace of the hikes may begin slow, the Federal Reserve signaled they are not oblivious to the potential economic impact of increased rates. In their statement the Fed said that in determining future hikes, they will consider “the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” The market however chose to focus on Fed Chair Powell’s comment that it was “premature” to talk about a rate hike pause and that the terminal rate would likely be higher than previously stated.

Despite the risks of a recession, the labor market is the one area of the economy not in need of a change. U.S. jobs growth continues to exceed expectations. The government reported on Friday that the economy generated 261,000 new jobs in October, above forecasts for around 200,000. In addition, a separate monthly report issued on Tuesday showed that job openings rose to 10.7 million which is also above expectations.

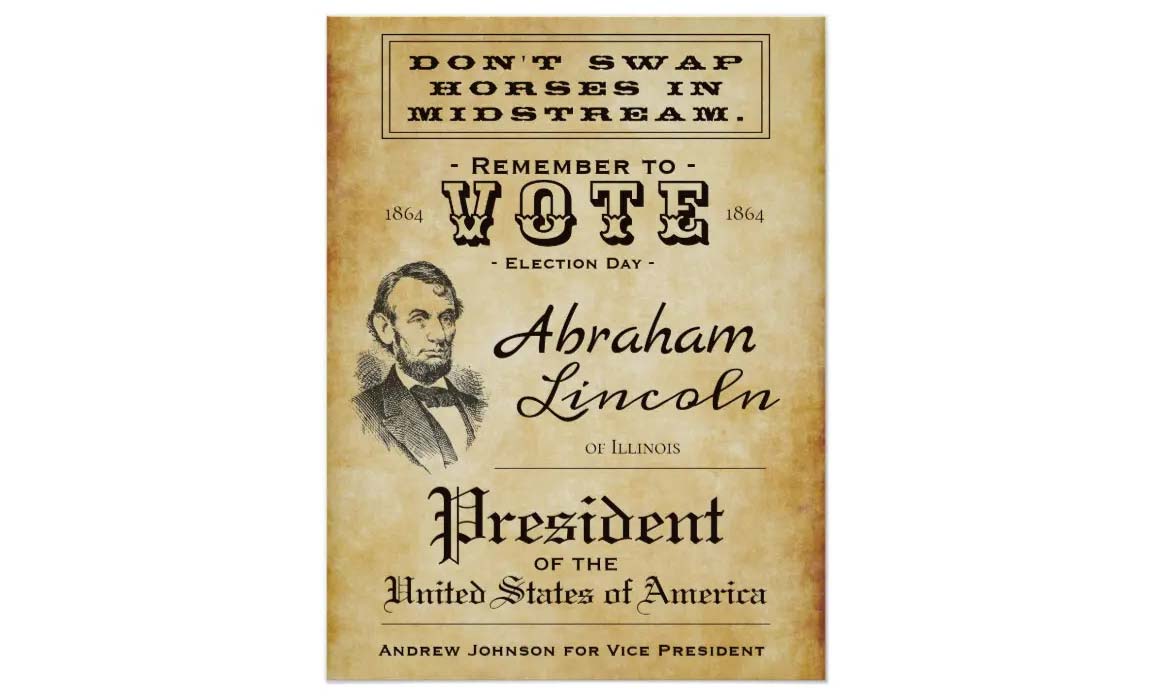

The U.S. large-cap growth stock benchmark dropped nearly 6% for the week, lagging a value equity benchmark by a wide margin. You may be tempted to sell out your growth stocks, don’t. If you are fully invested, the best thing to do right now is to stay the course. Since the start of October, the growth style benchmark has added nearly 1% while its value counterpart has gained more than 9%. Value stocks have been propped up by the energy sector which continues to do well. Without the energy sector’s surging growth, companies across the S&P 500 would be reporting a year-over-year decline in profits of around 5% this earnings season. Armed with that knowledge you may want to abandon growth stocks. Getting out now at a low point and chasing returns in the energy sector is NOT the right move. Once sentiment turns positive and it eventually will, growth stocks will be ones to lead us higher.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time. If you are overdue for a review and haven’t gotten on calendar please do so.