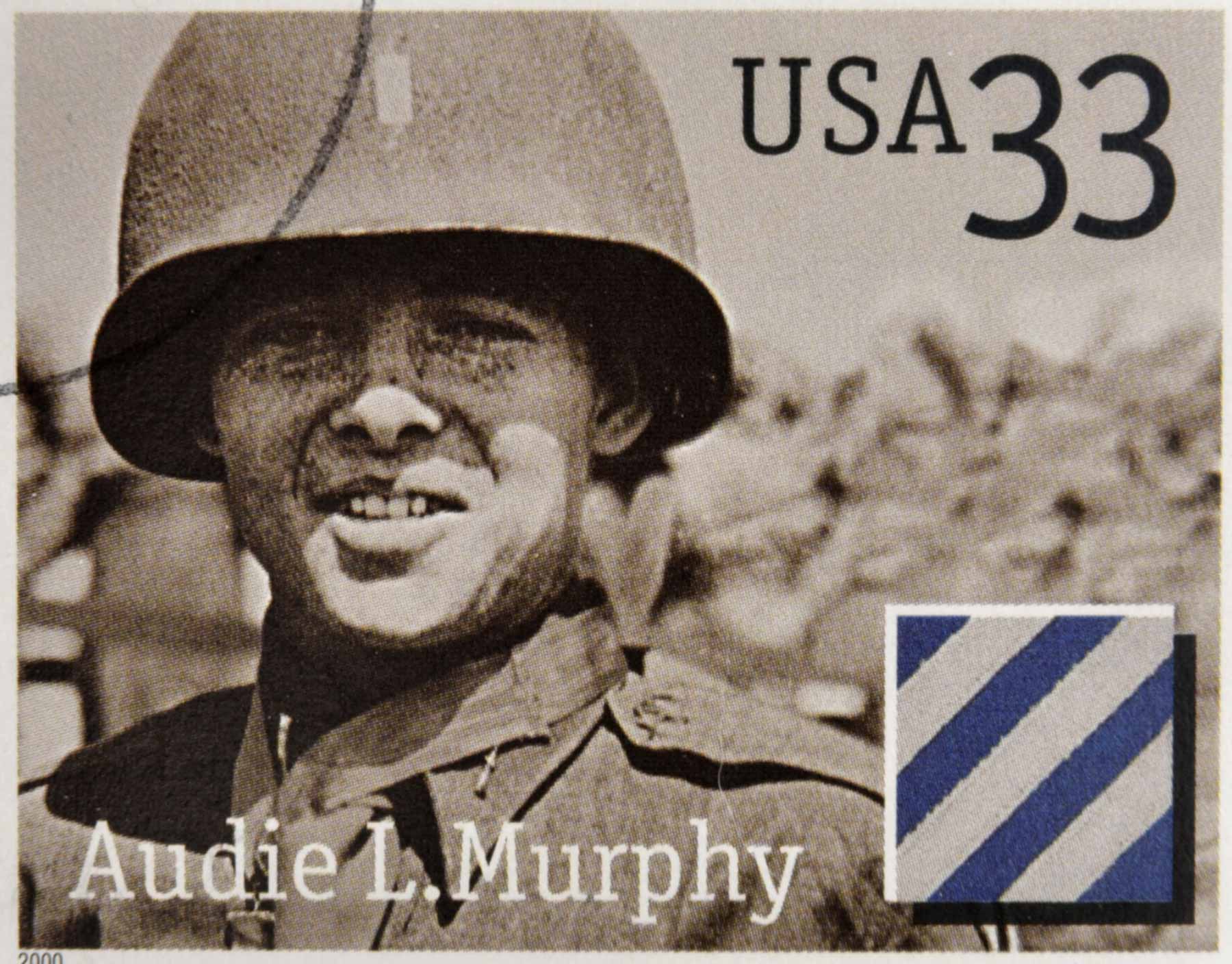

Hope all is well. Happy Veterans weekend and thank you to all those who have served. The major U.S. stock indexes rebounded in a big way from the previous week’s declines, driven largely by a one-day rally on Thursday that was the largest in two and a half years. The NASDAQ posted the top result with a weekly gain of more than 8%; the S&P 500 added about 6% and the Dow rose around 4%. As it is Veteran’s day weekend I have broken this week’s update using quotes from one America’s most decorated and famous Veterans, Audie Murphy.

Inflation and the economy were supposed to drive people to the ballot box and motivate them to vote Republican. However, the much-forecasted red wave was more a red ripple. While at this moment we still don’t know the balance of power it appears there will be new leadership in the House of Representative. A split of power is usually a good thing for markets. Lots of factors go into how markets perform, and, in general, people overestimate the impact of politicians, especially over the long term. What the market doesn’t like is uncertainty and it seems we are getting closer to having the uncertainty over the election results resolved.

The markets have learned how to cope with inflation. While inflation remains elevated at 7.7% investors have learned to look beyond the headline number. There was a lot to like in this report. The price of goods dropped. Easing supply shortages, lower consumer demand, and excess retailer inventories are all contributing to a sharp slowdown in the price of goods. Goods inflation declined 0.4% month-over-month. Sorry used car salesman but a drop in used car prices helped fuel the decline. Price increases for services continue but at a slower pace. Housing inflation (shelter) is the biggest services component and accounts for about a third of the overall CPI index. It grew in October, but hotel rates (lodging) were a big factor in that growth. Lodging tends to be the most volatile part of that number. Rent inflation is what market participants are really watching and that slowed for the first time in four months. Home sales and prices have been declining for months due to the spike in borrowing costs and it was always just a matter of time until that reflected in rents and ultimately CPI.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time. If you are overdue for a review and haven’t gotten on calendar please do so.