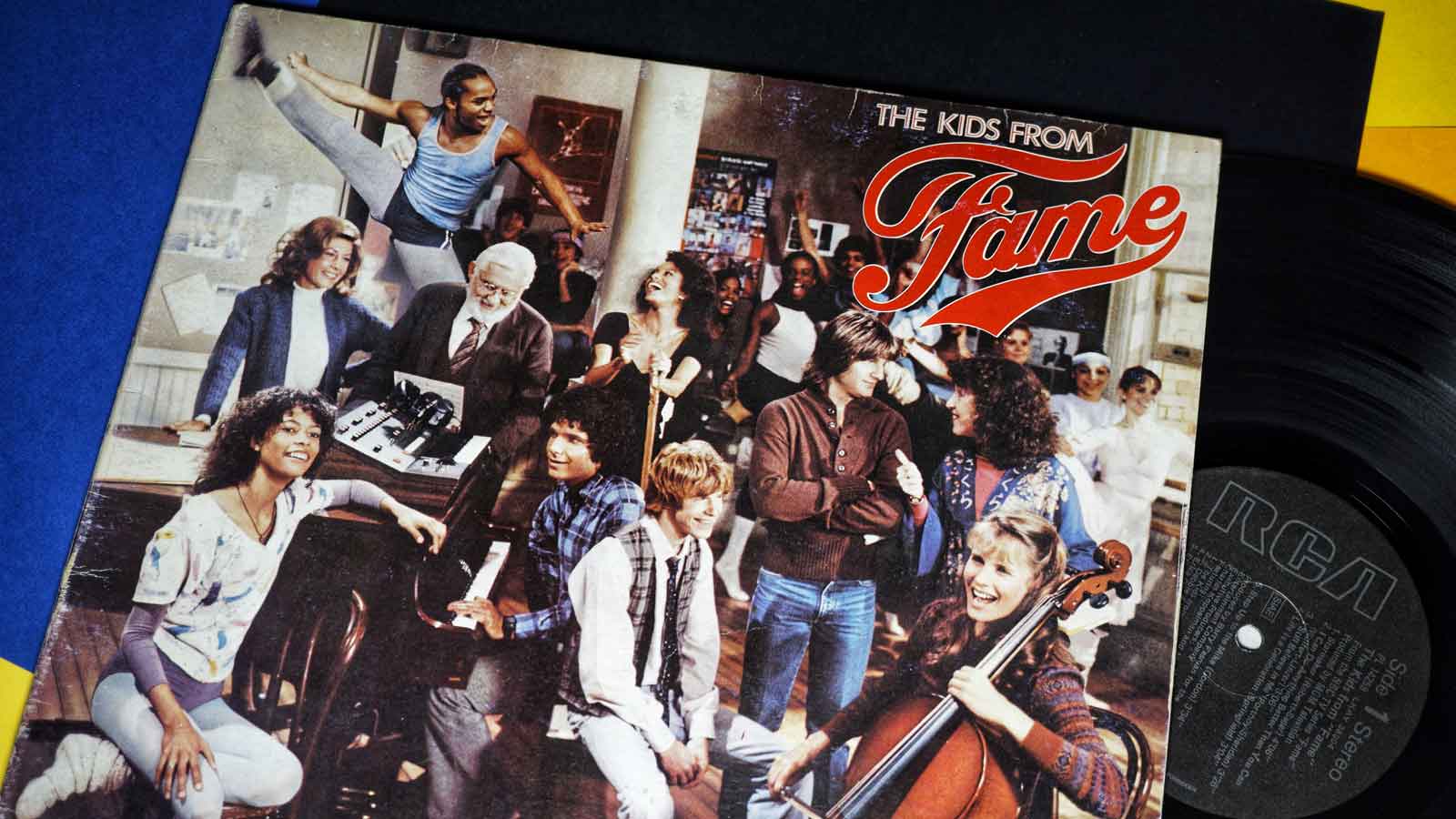

Hope you are all doing well and that you had a nice Thanksgiving weekend. U.S. stock indexes posted weekly gains of around 1% to 2%, with the Dow and the S&P 500 again outpacing the NASDAQ to widen the latter index’s year-to-date underperformance gap versus its peers. With its latest weekly result, the S&P 500 has risen more than 12% from a recent low in mid-October. Irene Cara, who gave us two mega hit songs in the 80’s passed away this week, I have broken down this week’s update using lyrics from each song.

For the better part of 2022 it has seemed as if the dream of a pause in the rate hikes was distant. However, Wednesday’s release of minutes from the most recent U.S. Federal Reserve policy meeting showed that most Fed officials were inclined to slow the pace of interest-rate increases. A “substantial majority” believed that a slowdown “would likely soon be appropriate,” according to the minutes from the Fed’s early November meeting. In each of the past four meetings, officials have approved rate hikes of three-quarters of a percentage point. The Federal Reserve’s ongoing response to bring down inflation will likely continue to drive markets in the coming months. We don’t know exactly how far the Fed will need to raise rates to constrain inflation, it’s likely the late innings of this tightening cycle. Expect inflation to trend downward over the coming months, creating a more positive market environment and easing some pressure on your investment portfolios.

It is starting to feel like we have turned the corner in this bear market. It’s not just inflation that’s trending down. Oil declined, the price of U.S. crude oil fell nearly 5% in the latest week, trading below $77 per barrel on Friday after data showed that U.S. gasoline stocks rose more than expected. Oil is down more than 17% from a recent high of nearly $93 on November 3. Volatility is also starting to fade. U.S. stock market volatility fell for the fifth week out of the past six. The Cboe Volatility Index fell about 11% for the latest week; on Friday it was down about 40% from a recent high on October 11. The dollar is softening which should help with the trade imbalance. The greenback has declined more than 5% from a recent high on November 3. These are all positive developments and could provide the framework for an extended rally from the October low.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment, please note the calendar will not allow you to schedule the final 3 weeks of the year. If there is something specifically you would like to touch base on before the end of the year and you are unable to schedule before December 10th then let me know by email and I will make accommodations.