Market Breakdown for the week.

Hope you are doing well and that you had a nice Thanksgiving. U.S. stock indexes climbed for the fourth week in a row as the S&P 500, the NASDAQ, and the Dow posted gains of around 1% in a holiday-shortened trading week. Over those four positive weeks, the S&P 500 was up nearly 11%. With a little over a month left in 2023, U.S. growth stocks maintained a big performance gap over their value style counterparts. This is a sharp reversal from 2022, when value outpaced growth. Through Friday, a U.S. large-cap growth index was up 36.7% year to date on a total return basis; the return for its value-style counterpart was 4.8%. Marty Krofft passed away yesterday, if you watched television on Saturday morning as a child you are probably familiar with his work. I have broken down this week’s update using some of the shows he created.

Dr. Shrinker

All those market prognosticators who expected corporate profits to be hit by a shrink ray this quarter were proven wrong. With nearly all third-quarter results in as of Friday, companies in the S&P 500 are expected to post an average earnings gain of 4.3% over the same quarter a year earlier. That result would mark the first quarter of earnings growth since the third quarter of 2022.

The positive earnings season has quelled the volatility in the market. U.S. stock market volatility fell for the fifth week in a row. The Cboe Volatility Index (VIX) on Friday was trading around 42% below a recent peak on October 20. Volatility is low because a recession which was considered an almost certainty is becoming much less likely. Strong earnings and low volatility sets up stocks nicely for the end of the year. The stock market has historically done well after Thanksgiving, with the market logging a post-holiday gain roughly three-quarters of the time over the past 30 years. The best was December 2010 with a rally of 6.5%, followed by 2003, 1999 and 1998, which saw post-Thanksgiving gains of more than 5%

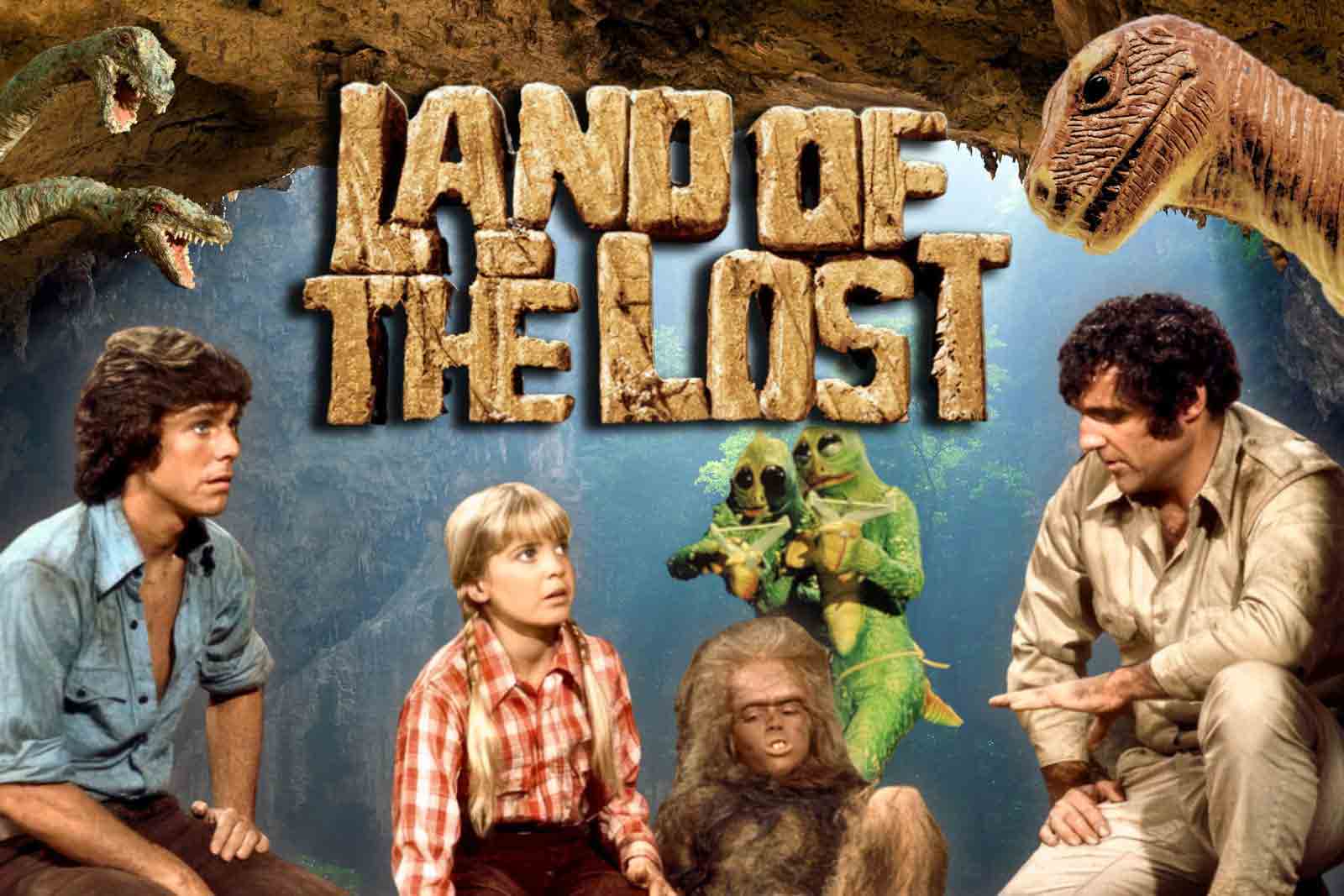

Land of the Lost

Like Rick Marshall in the show, the housing market is trying to survive with dangers everywhere. Interest rates have been the chief danger. U.S. sales of existing homes in October fell 14.6% from the same month a year ago to the lowest total in 13 years. With interest rates staying high, economists expect that 2023’s existing home sales total could end up being the lowest since 2011. If you were looking for the Fed to offer optimism, they did not. Tuesday’s release of Federal Reserve policy meeting minutes confirmed what I have been saying. Fed officials gave no indications that they were inclined to begin cutting interest rates anytime soon. Members agreed that Fed policies need to stay “restrictive” until data shows a convincing trend that inflation will return to the central bank’s 2% target.

Pryor’s Place

Richard Pryor doing a children’s show, that’s unexpected. A strong holiday shopping season is also not something anyone is expecting. The short-term outlook for U.S. retail sales was mixed as of Black Friday, the unofficial start of the U.S. holiday shopping season. A forecast from the National Retail Federation projects that holiday spending during November and December is likely to rise 3.0% to 4.0% from last year. Such an outcome would lag last year’s holiday sales growth of 5.4%. Don’t be surprised if the predictions are wrong. U.S. consumers are still spending and I would not be shocked if the holiday season beats expectations.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso by clicking the calendar link below and schedule a phone or zoom appointment at any time.

Visit our Services page for more information on how we can help you execute a reliable retirement income plan.