Hope all is well. Good economic news propelled stocks to new highs last week, with equities, bonds and commodities all rallying. The Dow surpassed 34,000 for the first time ever as all three major indexes finished up more than 1% on the week. I broke down this week’s news using cartoons.

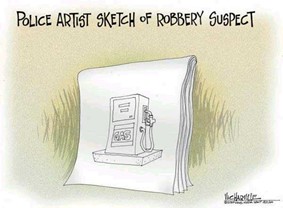

Inflation is starting to rise. Consumer Price Index (CPI) rose 0.6% in March from February and has increased 2.6% from year-ago. Energy was a major factor behind the jump, as gasoline prices have risen almost 23% year-over-year. The jump in gas prices comes just as people are starting to get back in their cars and go places again. This could eventually cause consumer spending to cool. The pickup in consumer spending has been significant of note clothing stores (+18%) as well as restaurants and bars (+13%) suggests that the easing of restrictions and progress in vaccinations are leading to a resumption of typical spending habits. The increased spending has fueled this latest leg of the market rally. Inflation is unlikely to derail spending in the near term as there is still pent up demand but it bears monitoring.

Inflation is starting to rise. Consumer Price Index (CPI) rose 0.6% in March from February and has increased 2.6% from year-ago. Energy was a major factor behind the jump, as gasoline prices have risen almost 23% year-over-year. The jump in gas prices comes just as people are starting to get back in their cars and go places again. This could eventually cause consumer spending to cool. The pickup in consumer spending has been significant of note clothing stores (+18%) as well as restaurants and bars (+13%) suggests that the easing of restrictions and progress in vaccinations are leading to a resumption of typical spending habits. The increased spending has fueled this latest leg of the market rally. Inflation is unlikely to derail spending in the near term as there is still pent up demand but it bears monitoring.

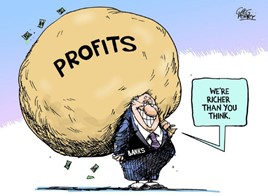

Earnings season kicked off S&P 500 earnings are expected to grow almost 25% in the first quarter, the strongest growth rate since 2018. Banks were first up to report first-quarter results. Corporate profits for all 13 banks that reported comfortably exceeded estimates by 36% on average. Economic and corporate fundamentals will continue to improve beyond the coming quarter and year, but the rate of change will slow. Expect  the market to be a little more volatile over the next couple of months with pullbacks likely to become more frequent. That does NOT mean you should get out of stocks. Stocks remain the best investment for the growth piece of your portfolio as the market longer term should remain on an upward trajectory despite increased volatility. What it means is if you have money in stocks that you’re planning to spend before the end of the year now might not be a bad time to take some risk off the table.

the market to be a little more volatile over the next couple of months with pullbacks likely to become more frequent. That does NOT mean you should get out of stocks. Stocks remain the best investment for the growth piece of your portfolio as the market longer term should remain on an upward trajectory despite increased volatility. What it means is if you have money in stocks that you’re planning to spend before the end of the year now might not be a bad time to take some risk off the table.

I am here to help at any time. If you would like to schedule a phone/web conference appointment, I have included a link to my calendar below and you can self schedule.