Hope you are all doing well. The S&P 500 joined the NASDAQ in correction territory on Thursday, falling 10% below its record high reached three weeks earlier. While the S&P 500 recouped some of its losses with a 2.1% surge on Friday, it ended the week with an overall decline of about 2.2%. That marks the fourth negative weekly result in a row. Tomorrow is St. Patrick’s Day so I have broken down this week’s update using some Irish terminology.

Sure look” – Expresses acceptance of something beyond one’s control, like “it is what it is”

Senator Shumer said sure look to democratic members of the Senate on Thursday evening and a government shutdown was averted. That should help the markets a bit next week. However, don’t be surprised if the market does really rebound meaningfully until April because on April 2nd is when the reciprocal tariff policy goes into effect. Assuming it is implemented the market will likely remain volatile while investors try to determine what impact it will have on the US economy.

“Sláinte” – This is the Irish word for “health” and is a common toast, similar to “cheers”.

Investors should have been raising a glass to toast better than expected inflation numbers and overall economic health. That is not what happened, instead the market dropped after the President announced a 200% tariff on champagne. The Consumer Price Index (CPI) report and a subsequent reading on prices at the wholesale level prices (PPI) reversed a recent trend of slightly hotter-than-expected inflation. Wednesday’s consumer prices report showed that core inflation, excluding volatile energy and food prices, rose at an annual rate of 3.1% in February. The figure was down from 3.3% in January and was below economists’ consensus forecast. The underlying fundamentals remain strong so do not panic if stocks go down because they will bounce back.

“Arseways” – This means something has gone completely wrong or turned into a mess.

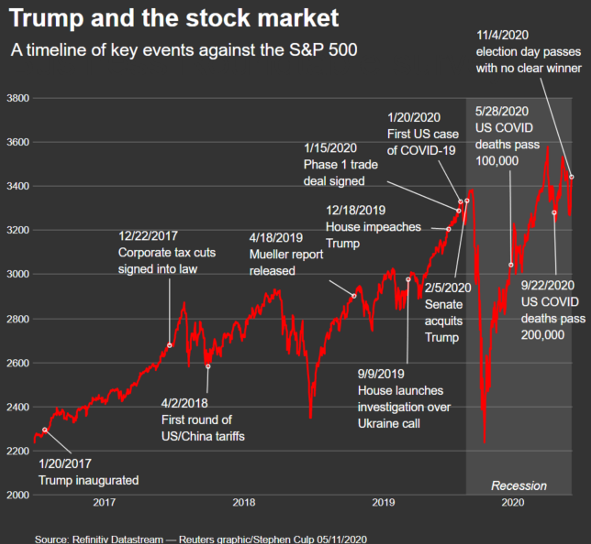

The market has gone arseways and the S&P 500’s correction has many of you feeling unsettled. That is because we have had a long run of positive performance. It was just three weeks ago the market hit a record high. Over the course of 2023 and 2024, the index climbed a cumulative 53% without a comparably sized pullback. Corrections while uncomfortable are a completely normal occurrence. The fundamentals still suggest that we are still very much in a bull market. President 47 Trump has created a fast paced news cycle that lends itself to volatility. We have seen this before during the President 45 Trump administration. The market during 45 Trump tended to bounce back just as quickly as it went down. Just remind those of you who forgot what the market was like during that administration see the chart below.

If you’d like to speak about your investments or your plan, or if it has been a while since our last review. Please use my calendar link below and schedule a phone or zoom appointment.