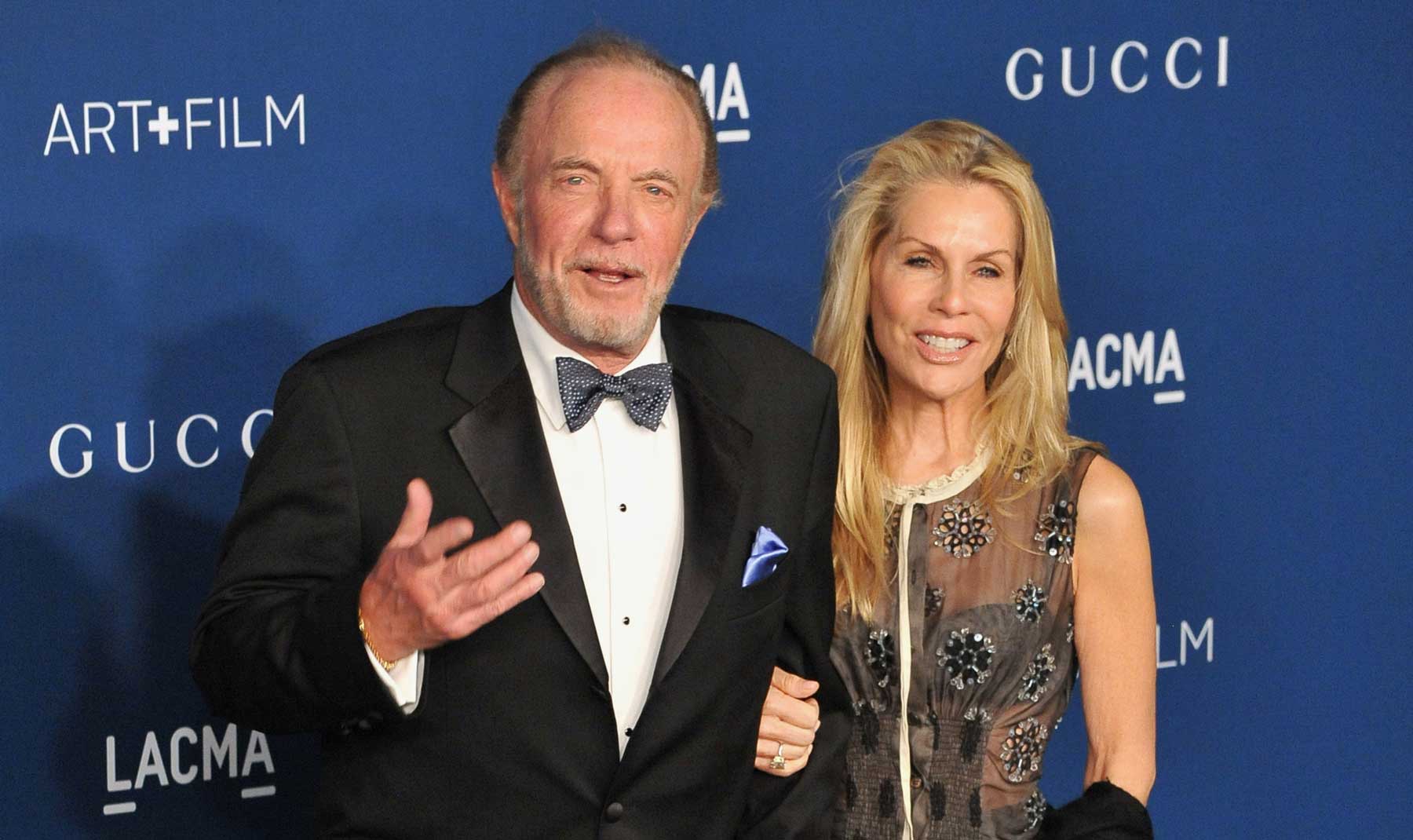

Hope all is well with you. U.S. stocks posted modest weekly gains, reversing the negative trend of the previous week. The NASDAQ was the best performer gaining nearly 5%, the S&P 500 adding 2%, and the Dow rising less than 1%. For the second time this year, the yield curve inverted, as the yield of the 2-year U.S. Treasury bond on Tuesday rose above the yield of the 10-year bond. An inversion is an indicator of the possibility that a recession could loom ahead. The curve also briefly inverted in early April as well. The market is starting to realize that while we may technically enter a recession later this month it may not be as bad as what has been priced in. In this week’s update I will point out some news and numbers that indicate why it may not be so bad. Tony Sirico (Paulie Walnuts from Sopranos) and James Caan (Sonny Corleone from the Godfather) both passed away this week, I have broken down this week’s update using some of their memorable quotes.

In a typical recession just as in a fictional mafia war business usually suffers. That has not been the case so far. The labor market continues to be strong. Despite high inflation, the U.S. labor market continued to post strong growth in June. The economy generated 372,00 new jobs exceeding most economists’ forecasts. The unemployment rate held steady at 3.6% for the fourth month in a row which is right near the 50 year low. Average hourly earnings rose 5.1%. There are two job openings for every individual who is unemployed that is not a backdrop that is consistent with a recession.

Like Paulie’s classic misunderstanding in the Pine Barrens episode, the trade deficit and the corresponding negative GDP that has resulted is not being understood correctly. The year-to-date strengthening of the U.S. dollar relative to the euro has brought the value of the two currencies to the same level for the first time in two decades. On Friday morning, the value of a single euro fell as low as $1.008. The last time the two currencies reached parity was in late 2002. The reason we had a negative read on the economy last quarter was because of the trade deficit. The strong dollar hurts our exports and is one of the reasons we have a trade deficit. Trade deficits don’t necessarily mean our economy is struggling. It could mean that our economy is just significantly stronger than other parts of the world, which I believe is the case here.

Inflation is making the market look terrible. Inflation will need to drop for the markets to rebound and it appears it is starting to. The strength of the rebound depends on what happens to consumer demand. The early numbers seem to suggest the Fed’s policy is working. What matters is why the inflation is going down. Is it because we are getting more supply or is it because we have less demand? If inflation ultimately declines because a recession stifles demand that would not be great for the markets. However, the better scenario is that inflation is declining because of improvement in supply along with declining commodity prices. If that better scenario ends up being the case the Fed will have reduced inflation without significant harm to the economy and the markets will rally, maybe even as soon as the last quarter of this year.

Like Sonny Corleone not listening to his consigliere. The Biden administration is choosing to ignore some of the louder voices within the Democratic party in order to fight inflation.The goal of fighting climate change is being put on the back burner amid calls to increase fuel supplies in the face of soaring prices. On Friday the administration unveiled the environmental impact statement (EIS) for ConocoPhillips’ planned $6 billion Willow oil and gas project in Alaska. The Willow project area holds an estimated 600 million barrels of oil. The Biden administration’s new draft EIS was needed for the project to proceed. With the release of the draft, a 45-day public comment period takes effect before the administration makes a final decision. If the project is ultimately approved it would mark a significant shift for the administration as only a handful of centrist democrats like Senator Manchin are for the project. Biden governing more from the center would be perceived as a good thing by the markets and could help sustain a move higher.

My calendar link is below. If you haven’t done so I encourage you to schedule a review.