The S&P 500 and the Dow edged slightly above the record highs that they achieved the previous week and rose for the 12th time out of the past 13 weeks. The NASDAQ also posted a modest weekly gain but remained 3.7% below its historic high achieved on November 19, 2021. WWE was in the news this week with Vince McMahon stepping down and Netflix paying 5 billion dollars for the rights to their weekly television show “Raw”. I have broken down this week’s update using the catchphrases of some of their more iconic wrestlers.

At what price will the market consider growth stocks to be overvalued? Growth stocks have maintained their edge in the opening weeks of this year. At Friday’s close, the U.S. large-cap growth benchmark was up about 4.0% year to date while the value benchmark was up just 0.4%. Netflix reported earnings and their deal with WWE and the stock shot up to almost $580 per share. So at what price do investors ring the register and cash in their gains?

We may find out in the next week with five of the “Magnificent Seven” set to report earnings this coming week. In 2023, the seven stocks (Apple, Microsoft, Alphabet, Amazon, Meta Platforms , Nvidia, and Tesla) added more than $5 trillion in value to the S&P 500. Tesla reported this week and the numbers disappointed and we saw investors hit the exits. The stock dropped almost 15%. Will the companies reporting this week be more like Netflix or Tesla? Hard to know but one thing I am pretty confident in is that we will have a volatile upcoming week. Key earnings reports and a Fed rate decision mid week could lead to big moves in either direction.

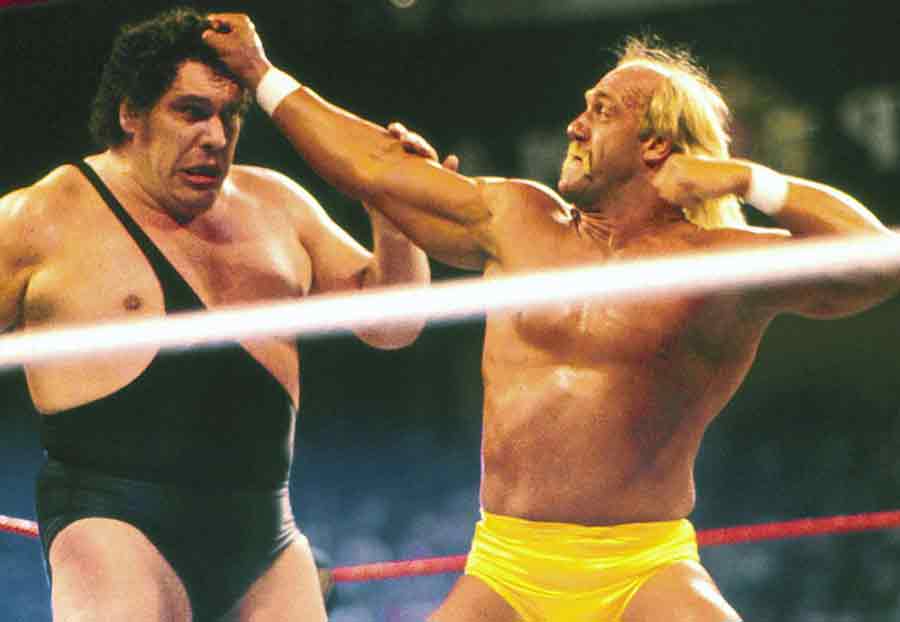

The economy like Hulk Hogan body slamming Andre the Giant continues to do what many thought was impossible. It continues to expand despite the aggressive rate hikes. The U.S. economy again exceeded most economists’ expectations in the fourth quarter as gross domestic product (GDP) expanded at a 3.3% annual rate. GDP growth exceeded forecasts,of 2.0% growth. The number is backward looking but supports the narrative that the U.S. economy is not getting soft as we enter the new year. Moreover, the data shows that economic growth accelerated at the end of last year. A strong third and fourth quarter brought the full year GDP figure to 3.1%. Anxiety about a recession seems to have subsided.

Unlike the economy, corporate bottom lines have not been as rosy. Approaching the midpoint of earnings season, companies in the S&P 500 were on track to record the lowest quarterly profit margins in more than three years. The average net profit margin for the fourth quarter was 10.7% versus 12.2% in the previous quarter. If 10.7% remains the final number once all fourth-quarter results are in, it would mark the lowest profit margin since 2020’s second quarter.

The market reacted to new inflation data this week. It doesn’t matter what the market thinks, it only matters what the Fed does. The Federal Reserve’s preferred gauge for tracking inflation posted a modest 0.2% month-to-month increase in December. While the figure was up from a 0.1% decline in November, it closed out a year that saw the Personal Consumption Expenditures Price Index rise at an annual rate of 2.9% in 2023 excluding volatile food and energy prices, far below 2022’s level. It remains to be seen how the Fed will interpret this data vis a vis interest rate policy. However, the number potentially sets up a “Goldilocks” outcome of better-than-expected economic growth, coupled with easing inflation. That’s why even if we get a pull back in the coming weeks you should stay invested in stocks. I expect that the overall trend that we have seen so far this year of the S&P 500 pushing higher and the 2-year Treasury yield ticking lower, will continue throughout this year despite pockets of volatility.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso directly by clicking the calendar link below and schedule a phone or zoom appointment at any time. Effective May 1st in person appointments outside of the office or normal business hours will carry an additional fee of $75.