Hope all is well with you and that you are staying safe as both Covid and winter weather are raging throughout the country. The second week of 2022 delivered another negative result for the major U.S. stock indexes, which slipped less than 1% as quarterly earnings season got under way. Concerns about rising inflation and interest rates continued to weigh on stocks. Here’s what happened this week.

Growth Stocks Continue to Lag

The recent underperformance of technology stocks has made it a rough start for growth equities in 2022, as a U.S. large-cap growth index lagged its value-oriented counterpart for the second week in a row. So far in 2022, the growth benchmark has fallen nearly 6%; its value peer is up about 1%. With companies starting to report earnings that trend could reverse.

Inflation and Covid Soar

Year over year inflation is a 40 year high with prices going up over 7% in the last year. Wholesale prices, which is what businesses pay for goods, services and construction rose less than expected in December but still set a new all-time high growing by 9.7% year over year. Inflation continues to be fueled by supply chain disruptions which have gotten worse with the surge in Covid cases. Inflation has greatly exceeded wage increases and the cost-of-living adjustment on Social Security. The SS COLA was 5.9% and the average wage increase for Federal employees 2.7%.

System of Checks and Balances

The Supreme Court blocked the Biden administration and their vaccine mandate. The decision prevents the government from enforcing its sweeping vaccine-or-test requirements for large private companies. It did allow similar requirements to stand for medical facilities that take Medicare or Medicaid payments. That mandate would have required that workers at businesses with 100 or more employees must get vaccinated or submit a negative Covid test weekly to enter the workplace. It also required unvaccinated workers to wear masks indoors at work.

Some Student Loans Canceled

Navient said it resolved all six of their outstanding state lawsuits. Company officials said they will cancel $1.7 billion in private student loans after a deal it reached with 39 states. The settlement, announced on Thursday, resulted from accusations the lender gave out loans to millions of borrowers who’d be unlikely to be able to repay them. The loans in question are private loans, meaning they are not guaranteed by the federal government. As part of the settlement, the company will make a one-time payment of about $145 million to the states.

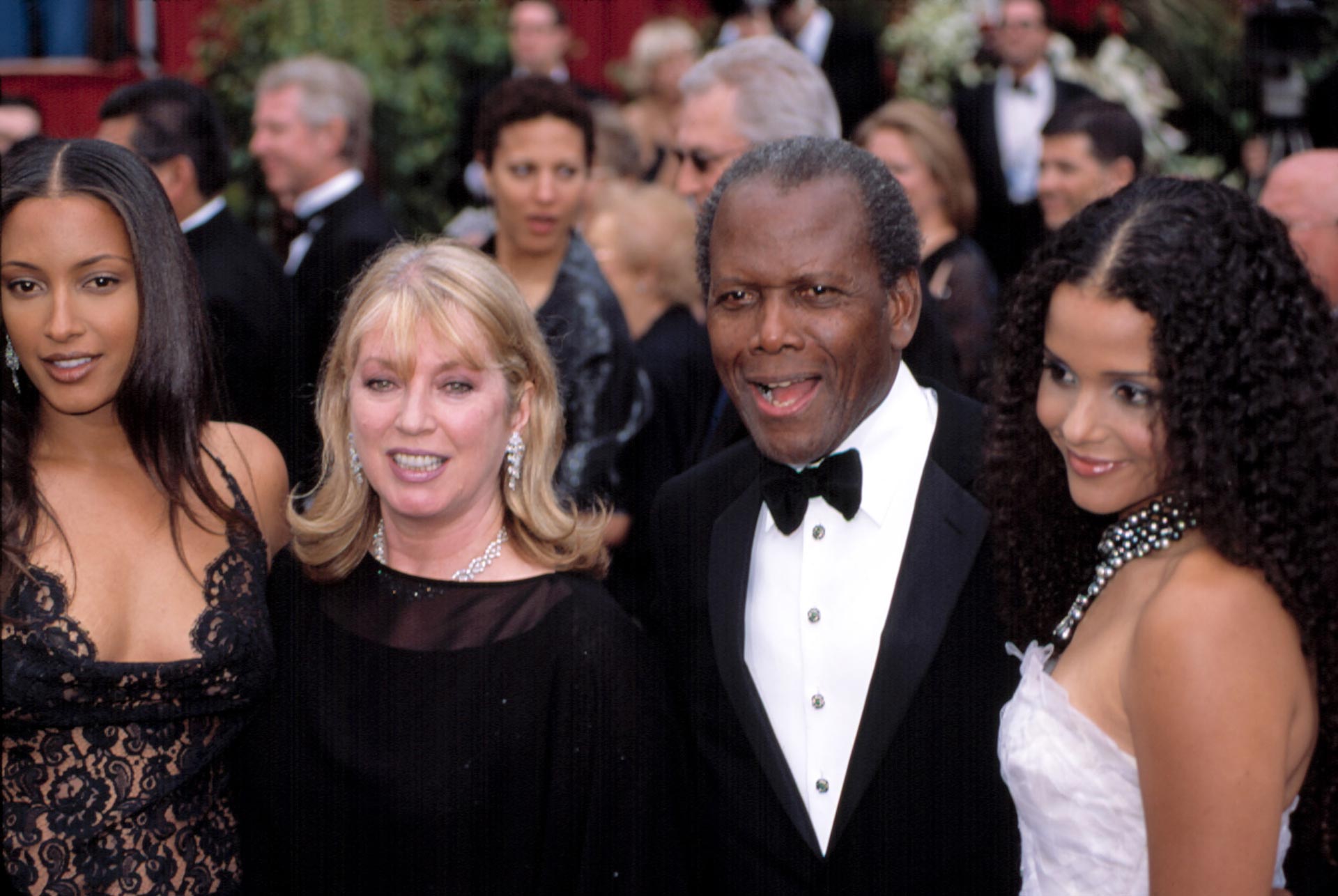

My calendar link is below and you can schedule a phone or zoom appointment at any time. You may notice I had no theme this week, instead in honor of the holiday I will close with a quote from Sir Sidney Poitier who passed this week at the age of 94.