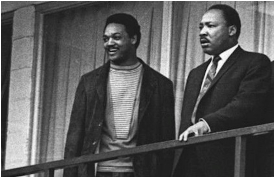

Hope all is well. The major U.S. stock indexes posted gains, rebounding from declines the previous week that snapped a year-end 2023 streak of nine positive weeks in a row. At Friday’s close, the S&P 500 was within 0.3% of the record closing high that the index set on January 3, 2022. Tomorrow is Martin Luther King Jr. day and the Iowa Caucus, I have broken down this week’s update using quotes from the Rev. Jesse Jackson who has knowledge of both.

If you don’t know what tomorrow holds, you need to know who holds tomorrow!

None of us know for sure where the market is heading but the Federal Reserve seems to be controlling the strings. The rally this week was based on the market trying to guess the path of interest rates which will largely be determined by the direction of inflation. To that end this week we got two monthly price reports . The reports extended the recent trend of uneven progress to curb inflationary pressures. The Consumer Price Index (CPI) posted a month-to-month rise of 0.3% in December. That was slightly above most economists’ expectations and the third monthly increase in a row. However, the Producer Price Index, which tracks prices that factories charge wholesalers, slipped 0.1%. The acceleration from last month’s 3.1% reading in CPI on the surface seems worrisome. However, the market cares about how the Federal Reserve will react to the number. The Fed cares about core CPI, which excludes food and energy.

That continued to slow, falling to 3.9% from 4%. While that was the lowest reading in two and half years, and was mostly in line with forecasts, core inflation is still well above the Fed’s target of 2%. Most of the core inflation came from shelter, which contributed over half of the overall increase in inflation. Another interesting nugget from the report that bears watching is car insurance costs. Car insurance surged 20% from a year ago, the most since 1976. Used car prices increased over the past month despite forecasts for a decline. The good news is used cars were really the only goods that were inflating. Inflation for other goods declined slightly from the prior month. There is nothing in this week’s numbers that suggest the Fed will be in a rush to reduce rates, even though that is what the market expects. The bond market is currently pricing in a 75% chance that the first rate cut will be delivered in March. I don’t think that is going to happen. I expect a bout of market volatility around each Fed meeting this year starting with the first meeting at the end of this month. I expect Fed policymakers to push back against the market’s rate cut expectations at this next meeting.

Never look down on anybody unless you’re helping him up.

For three decades, Japan’s economy has been looked down upon. Plagued by a combination of low growth, low inflation, and low interest rates it became a laughing stock. Using the word Japan in a financial discussion became synonymous with prolonged economic plight and usually accompanied by a warning or used to ridicule a decision made by another central bank or advanced economy. Japan’s economy is finally experiencing a revival. Thanks in part to a hand up from the currency market. The dollar hit an all time high against the yen in November of last year.

That allows Japanese exporters to increase their yen prices abroad, while in many cases reducing their prices in foreign currencies. It also makes imported goods more expensive in Japan which helps create more demand for their goods at home. That has led to a surge in the Japanese stock index which continued this week with a more than 6% gain. That is worth noting because its biggest weekly gain for the index since March 2020 and it left the index at its highest level since February 1990. While I continue to advise carrying a lower weighting of international stocks more broadly, I expect Japan continues to be a somewhat bright spot. That’s important for those of you holding international index funds because it is the largest country in the index, as measured by market capitalization. Japan represents 21.6% of the index.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso by clicking the calendar link below and schedule a phone or zoom appointment at any time.