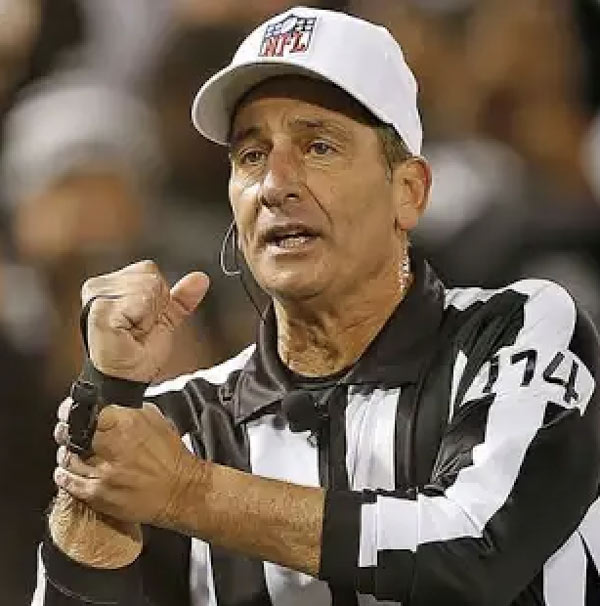

Hope you are all doing well. U.S. stocks slipped to start the week amid the imposition of tariffs and subsequent trade negotiations involving the United States, Canada, Mexico, and China. But stock indexes regained some of that ground, ending up with fractional declines for the week after some of the tariffs were temporarily rolled back. With the Super Bowl tomorrow, I have broken down this week’s update using penalty calls you are likely to hear during the big game.

False Start

The Labor market did not get off to the type of start analysts were hoping for. January’s gain of 143,000 jobs came in short of analysts’ expectations. The number marks a slowdown from the previous month’s figure. However, there were plenty of positives in the report; initial jobs growth estimates for November and December were revised upward by a combined 100,000 and the unemployment rate slipped from 4.1% to 4.0%, which is generally considered to be full employment.

Delay of Game

The Trump administration’s controversial “deferred resignation” program is delayed for the time being after a federal judge in Massachusetts enjoined the Office of Personnel Management from “taking any further action to implement the so-called Fork Directive.” Judge George O’Toole, a Clinton appointee, issued the order from the bench during a very brief hearing on Thursday afternoon, while emphasizing that he had not yet reached any conclusions about the program. Arguments on the program’s legal merits are scheduled for a separate hearing at 2 p.m. on Monday, also in Judge O’Toole’s courtroom. Even if O’Toole rules that it is illegal it will probably be appealed and ultimately could wind up in front of the Supreme Court. Where there is a strong chance it is ultimately deemed to be legal. So the offer may be delayed further but I feel it will ultimately stand. Assuming it stands, my opinion has not changed. I still believe the offer makes sense for those who are fully eligible to retire and have attained or will be attaining age 62 prior to September and have and will have 20 years of service prior to retirement. Assuming obviously you are financially and mentally ready to retire.

Illegal Formation

The Trump agenda has been rolling out so quickly many are wondering if some of it is even legal. Fear and speculation about the changes that could be implemented, has got some investors seeking safety in gold. The price of gold set a record high for the second week in a row, extending a nearly three-month price surge for the precious metal. On Friday, gold briefly traded above the $2,900-per-ounce level for the first time before retreating slightly to around $2,890 in afternoon trading. Twelve months ago, gold was trading just above $2,000.

Unnecessary Roughness

Investors are worried about taking an excessive hit to their portfolios. The monthly gauge of U.S. consumer sentiment fell to its lowest level in seven months as survey participants expressed concerns that tariffs could fuel short-term inflation. February’s preliminary reading from the University of Michigan’s sentiment index fell 3.3 points to 67.8, well below economists’ consensus expectations. The sentiment figures generally have little to no correlation with stock market performance. However, it does give you a read on the consumer and a pessimistic consumer could be less likely to spend which would have an economic impact.

If you’d like to speak about your investments or your plan, or if it has been a while since our last review. Please use my calendar link below and schedule a phone or zoom appointment. Enjoy the game!