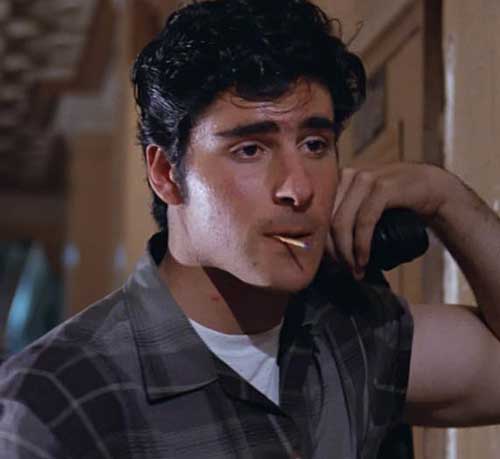

Hope all is well with you. A stronger-than-expected earnings report from Nvidia propelled the U.S. indexes on Thursday to their biggest daily gains in a year. The NASDAQ’s nearly 3.0% surge was its biggest in 12 months, while the S&P 500’s 2.1% rise was its largest in 13 months. The rally helped U.S. stock indexes rebound from the previous week’s mostly negative results. The NASDAQ’s gain of more than 1% left the index four-tenths of a percentage point below its record closing high set on November 19, 2021. The S&P 500 and the Dow added to record highs they had set 11 days earlier. Tony Ganios who played Meat in the Porky’s movies passed away this week. I have broken down this week’s update using quotes from Porky’s.

“Hey, no one’s forcing you, but it’s a long ride back home.” – Porky

It’s natural to have some trepidation about tech. The massive move in Nvidia is centered around artificial intelligence, there is a level of excitement around AI that has not been seen in the market in some time. The move in tech stocks is exuberant but not irrational. The future impacts of AI on the economy are significant both in the short term and long term. The move in tech is different from the internet bubble we experienced in the late nineties. We have had nearly 60% gain in the tech sector over the past year. So the comparisons by pundits to 1999 are understandable.

However, the comparisons to the tech bubble are wrong. At the tail end of the internet bubble before it burst in March of 2000 everything with a dot com in the name was going up indiscriminately. I had 85 year old clients asking me to purchase them the Munder net net fund. However, that shift in attitude didn’t happen in a year. The irrational exuberance, as Greenspan called it, built up over five consecutive years (1995-1999) of annual returns exceeding 20%. Most importantly, earnings across the dot-com stocks didn’t not support those gains. In the 1990s, the gains occurring across the board were based on potential growth and not a sustainable earnings base. Today, the excitement is concentrated in the largest companies with huge earnings. Case in point, Nvidia reported that revenue more than tripled from a year earlier to $22.1 billion, while profit soared nearly ninefold to $12.3 billion. Could we see a correction or pullback, maybe. I still view any pullback as a buying opportunity.

“In spite of the juvenile snickers of some, this is a serious matter.” – Beulah Balbricker

Japan has seriously tested the old adage to buy and hold. Though, if you did that you’re finally being rewarded. It took more than three decades, but the Japanese stock market index finally set a record high on Thursday, climbing above its prior peak established on December 31, 1989. Japan’s equity market fell into a two decade long slump in the early 1990s; it began its long rebound after hitting a low in early 2009.

Contact Laurel Wealth Solutions if you’d like to speak about your investments or your plan. You can also reach Stephen Caruso directly by clicking the calendar link below and schedule a phone or zoom appointment at any time. Effective May 1st in person appointments outside of the office or normal business hours will carry an additional fee of $75.