Happy and Healthy Holidays! This is the final update of 2022. So far in December, the Dow is down 4.5%, while the S&P 500 and Nasdaq have tumbled 6.3% and 8.7%, respectively. All three major averages are slated to break a 3-year winning streak and post their worst yearly performance since 2008. Franco Harris passed away this week and today is the 50th anniversary of his immaculate reception. I have broken down this week’s updates using some of the iconic plays from that Steelers dynasty.

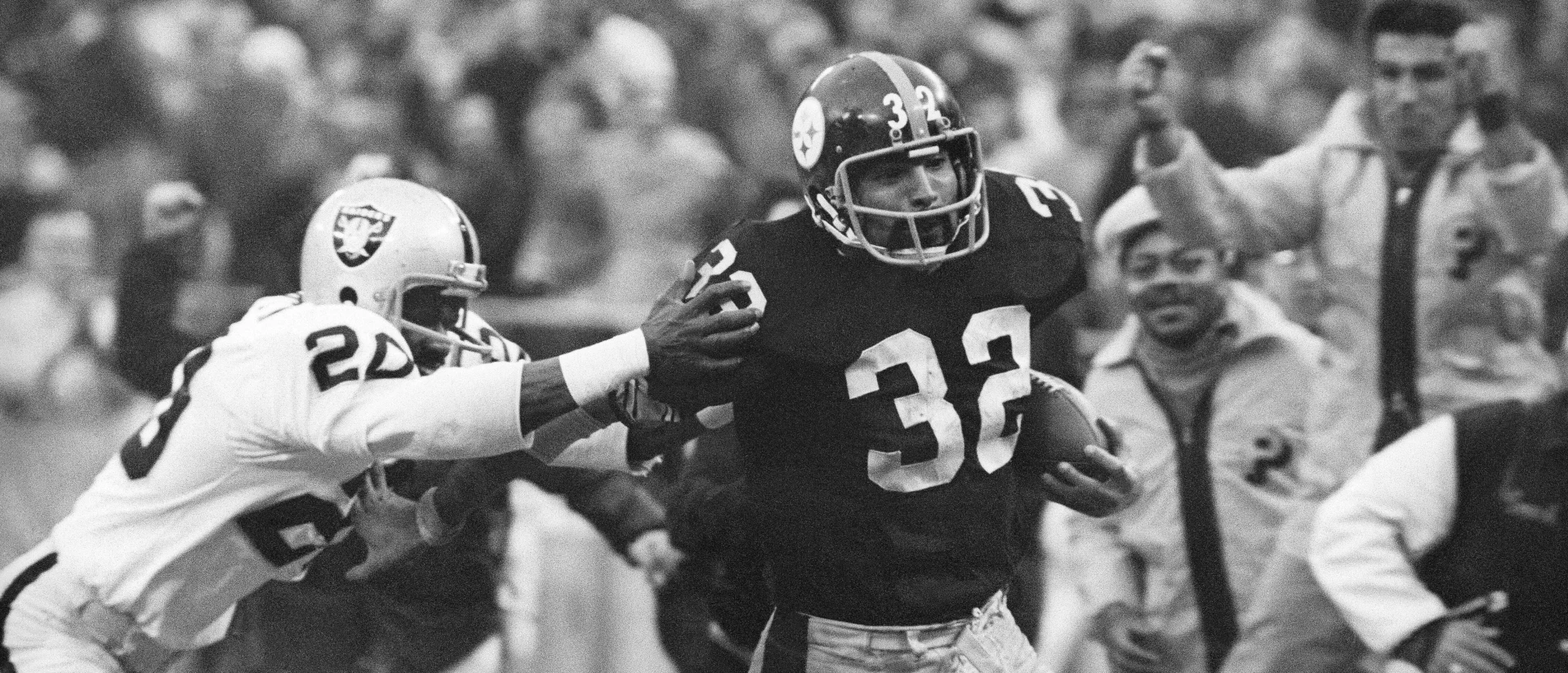

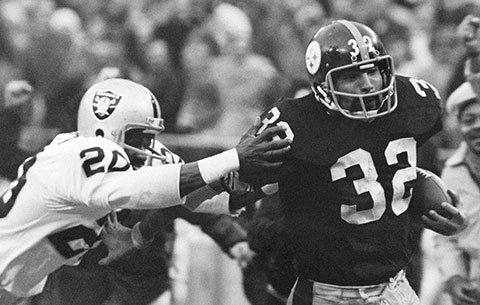

The Immaculate Reception

A worse-than-expected U.S. retail sales report for November has retailers hoping for a Christmas miracle like the immaculate reception. The report added to fears that further interest-rate increases could tip the economy into a recession. Sales fell 0.6% in November, reversing course from the previous month’s gain and recording the biggest decline in 11 months. One month does not make a trend. Slowing retail sales can be the first signal that consumer demand may be stalling. Consumers may be feeling the impact of aggressive rate hikes and the ongoing inflationary environment. The economy will likely fall into a mild recession in the middle of 2023 especially if consumer spending drops as it represents about 70% of economic activity. Remember however that the consumer started from a position of strength. People are working, wages are higher, and post pandemic savings remain elevated, that should provide some cushion in the months ahead and keep any potential recession from being too deep.

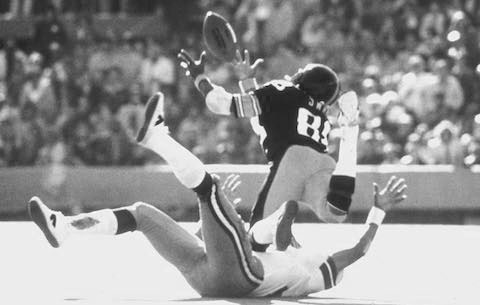

Lynn Swann’s juggling catch against the Cowboys in Super Bowl X

The Fed is juggling fighting inflation and economic growth. It remains to be seen if they will come down softly with the catch like Swann. The Federal Reserve lifted its benchmark interest rate for the seventh time this year, approving a more moderate half-percentage-point increase relative to its recent three-quarter-point hikes. However, Fed officials expect to keep the benchmark rate at a higher peak level next year than many analysts had forecast. Stocks have mostly retreated following the December 15th announcement. The U.S. Federal Reserve has had plenty of company in lifting interest rates by a half percentage point, as central banks in the European Union, the United Kingdom, and Switzerland also raised borrowing costs by the same amount. The U.K.’s Bank of England said that it believes the economy is in a recession. Fed Chair Powell went out of his way to say that while recent inflation data has been encouraging, inflation broadly remains elevated and well above the Fed’s 2.0% target. Markets often create their own assumptions about Fed policy. Powell has been very clear, but markets keep only hearing what they want to hear and underestimating how far the Fed will go. Fighting inflation continues to remain the Fed’s top priority, not the impact of higher rates on economic growth. However, even after this past Fed meeting, market expectations for the peak fed funds rate remain around 5.0%, perhaps indicating that markets don’t believe that the Fed will need to take rates materially higher. Markets may have this wrong. The Fed would like to bring inflation back down to 2% and will continue to raise rates until they see economic damage. With 5.1% wage growth and 3.7% unemployment the Fed has plenty of runway to keep raising rates. The market is implying perhaps two rate hikes of 0.25% each remaining in this cycle. I think we could see possibly another 4 months of rate hikes because it will probably take that long before the labor market starts to deteriorate in a meaningful way. Historically, the 12 months after the peak fed funds rate can be positive for both stock and bond markets, I see that peak happening around April.

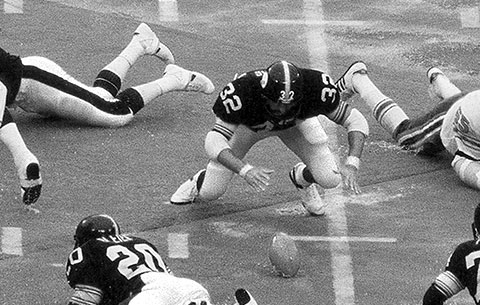

Mean Joe Greene’s Fumble Recovery & Interception against the Vikings in Super Bowl IX

Inflation has wreaked havoc on markets this year like “Mean” Joe Greene on the Vikings game plan. However, the tide may be starting to turn. U.S. prices rose at a 7.1% annual rate in November as measured by the Consumer Price Index (CPI), marking the smallest year-over-year increase since last December. Excluding food and energy costs, core inflation rose by 0.2% relative to the previous month. That was the smallest increase since August 2021. Overall, inflation is trending in the right direction, although CPI remains elevated and well above the Fed’s 2.0% target. Goods inflation continues to ease, with areas like used cars, apparel and even toys showing moderating price pressures. Parts of services inflation, including medical and transportation services (like airline fares), were lower this month. Core inflation won’t come down meaningfully until shelter and rent prices come down. Core shelter and rent prices in the CPI basket remained elevated. That’s not surprising as that tends to lag changes in other real estate related indicators and those indicators are saying the housing and rental markets are notably weakening. That means it is only a matter of time before that number finally starts to drop in a meaningful way. Over time, the core CPI index will reflect the weakening in housing and rental markets as well, and I wouldn’t be surprised if core inflation headed towards 3.0% by year-end 2023.