Hope you are all doing well. The major U.S. stock indexes rallied to close July out as the best month in the stock market since 2020. This was a significant week of market moving news. The major tech companies, Alphabet (Google), Meta (Facebook), Apple and Amazon all reported earnings, and the reports except for Meta were fantastic. In addition to tech earnings, we also had the July Federal Reserve rate decision, and the second-quarter GDP (gross domestic product) reading. In other major news this week, Klondike discontinued the Choco Taco and outraged a surprising number of Choco Taco fans. I have chosen to break down this week’s news using other products that drew similar outrage when they’ve been pulled from the shelves.

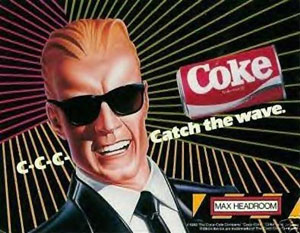

Like when Coca Cola pulled tried to replace Coca Cola with new Coke (and Max Headroom) and people scrambled to get the old Coca Cola before it ran out. Well the same thing is happening in the mortgage market. Fed policy tightening continued as they enacted a 0.75 percentage point rate hike on Wednesday taking its benchmark rate to a range of 2.25% to 2.50%. This is the Fed’s second consecutive 0.75 percentage point interest-rate hike. Mortgage rates went about 5.5% after the rate hike before falling Thursday and Friday down to 5.13%. The days of the sub 3% mortgage are probably gone, but who knows maybe a bank will bring it back and call it Mortgage Rate Classic like Coca Cola.

We officially entered recession territory on Thursday as GDP contracted at -0.9% for a second quarter in a row. The markets took news a lot better than Twinkie fans did when Hostess tried to get rid of the beloved treat. Stock surprisingly rallied on Thursday following the news. Here’s the bad news from the report. Compared with the first quarter, the second-quarter figure clearly showed signs of slowing: consumption slowed to a pace of 1.0%, down from 1.8%, and residential investment fell sharply, down -14% compared with +0.4% growth last quarter. The good news is consumer spending is still positive and spending services grew by over 4%. The spending on services tells you we are starting to get back to the good old days of our pre-pandemic lifestyle, like when we were young and could enjoy Twinkies as a lunchbox snack without worrying about the health implications.

My calendar link is below. If you haven’t done so I encourage you to schedule a review. I will be out of the office the next two weeks so I will not be available for appointments but will be checking and responding to voicemails and emails.