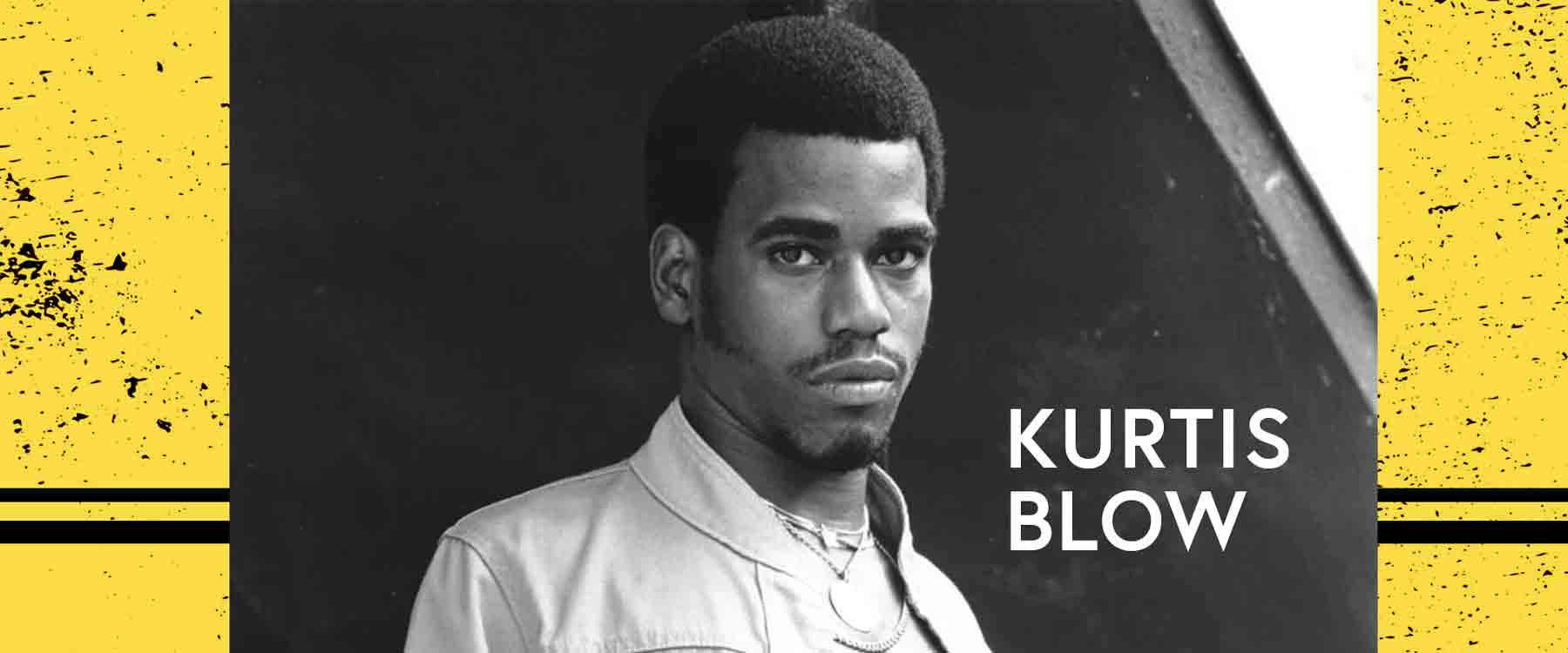

Hope you are all doing well. Stocks have struggled to sustain their rally in the late summer. Last week, the S&P 500 and Nasdaq Composite fell 0.31% and 1.90%, respectively. It was the Nasdaq Composite’s first two-week losing streak of the year. The Dow slipped sharply on Tuesday but rebounded to finish slightly higher than last week. This week marks the 50th anniversary of hip hop music. As such I have broken down this week’s update using lyrics from one of the first mainstream hip hop songs, Kurtis Blow’s, The Breaks.

Breaks run cold and breaks run hot

Inflation is cooling after 18 months of running hot. United States inflation, as measured by the Consumer Price Index (CPI), was 3.2% in July, slightly below market expectation. Core inflation, which excludes energy and food, rose 0.2% for the month, the same rate as in June. The shelter component, which makes up about 40% of the core CPI basket, continued to rise. The encouraging news is that it rose at the slowest monthly pace since its recent high. Remember real estate prices are a lagging indicator, so expect shelter inflation in the CPI basket to continue to slow.

And you borrowed money from the mob…And yesterday you lost your job

Lending costs are going up for much of the banking sector. As a result some banks are losing their good credit ratings. Moody’s cut the credit rating of 10 small and midsize U.S. banks on Monday. The ratings agency noted it has several larger lenders under review. The move from Moody’s reflects the challenges the banking industry still faces including the potential for reduced profitability.

Breaks to make your wallet lean

Investors are taking a break from big tech stocks before their gains get leaner. The Nasdaq and S&P have pulled back from their recent highs. This pullback in the market leaders could be a buying opportunity. Historically, strong rallies in the S&P 500 are typically followed by some form of pullback or correction. Many times the pullbacks are not long-lasting. Since 1950, there have been 35 instances of the S&P 500 rallying over 15% as it has just done. On average, there has been at least one pullback that follows in the six months after the rally. These pullbacks have a median of negative 7.6%. In most instances, markets recovered pretty quickly (two to six months). There is no catalyst for a prolonged pullback, this pullback was inevitable as investors cash in some of the profit made on these big tech names. It could drop a little further but I expect it will rebound fairly quickly with the indexes ending the year higher than where they are now.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment at any time.