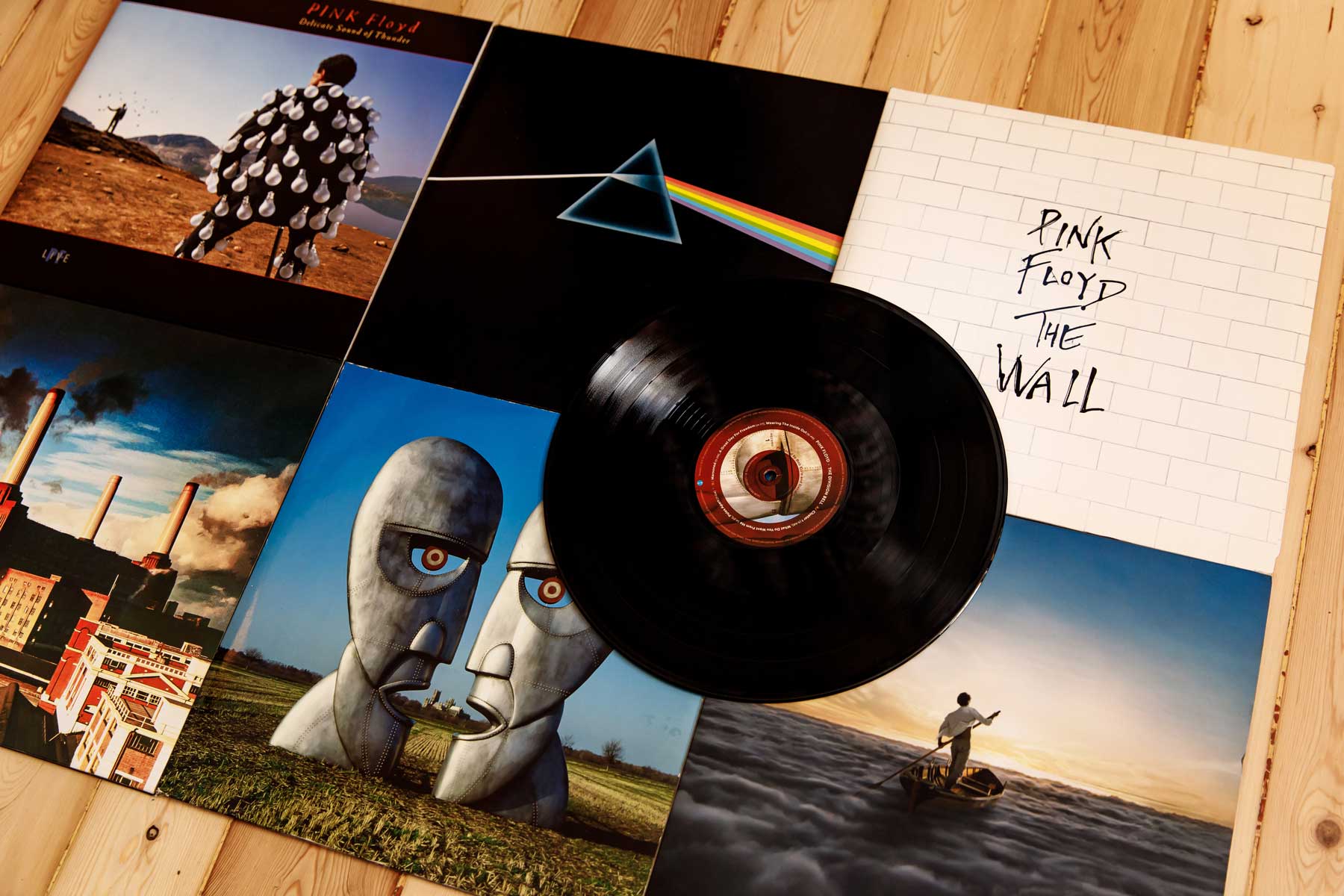

The major U.S. indexes gave back some of the gains they recorded in March, as stocks pulled back after a strong start to the week. On a total return basis, the S&P 500 fell about 1.2%, the Dow slipped 0.2%, and the NASDAQ dropped 3.8%. Pink Floyd announced this week they will release their first new music in 28 years in support of Ukraine. I have broken down this week’s news using lyrics from the Pink Floyd classic, Money.

The labor market continues to be the most encouraging signal about the durability of this post Covid economic expansion. The U.S. unemployment rate is at just 3.6%, initial applications for unemployment benefits are also dropping to unusually low levels. Thursday’s latest weekly count of unemployment claims fell to 166,000. That is the lowest weekly figure since 1968, and down 5,000 from the previous week. Historically recessions start with a rise in unemployment. The record-high ratio of job openings to unemployed suggests strong consumer incomes. If you have more pay then you’re okay even with the inflation we are experiencing.

The Fed is not giving any money away. Minutes from the U.S. Federal Reserve’s mid-March meeting showed that policymakers discussed the possibility of raising the Fed’s benchmark interest rate by a half-percentage point at a meeting scheduled early next month. It was also revealed that the Fed expects to shrink its asset holdings, which along with rate hikes will further tighten monetary policy. The Fed will allow up to $95 billion in bonds ($60 billion in Treasuries and $35 billion in mortgage bonds) to mature every month without being replaced. This action removes more money from the financial system, which means higher yields and more pain for bond investors. This is not something new or unexpected. The Fed followed a similar course of action pre-pandemic, shrinking its asset portfolio between 2017 and 2019 without a dramatic effect on the stock market.

My calendar link is below. If you haven’t scheduled a review or you just want to have a quick call to discuss your investments please use the link and schedule a time.