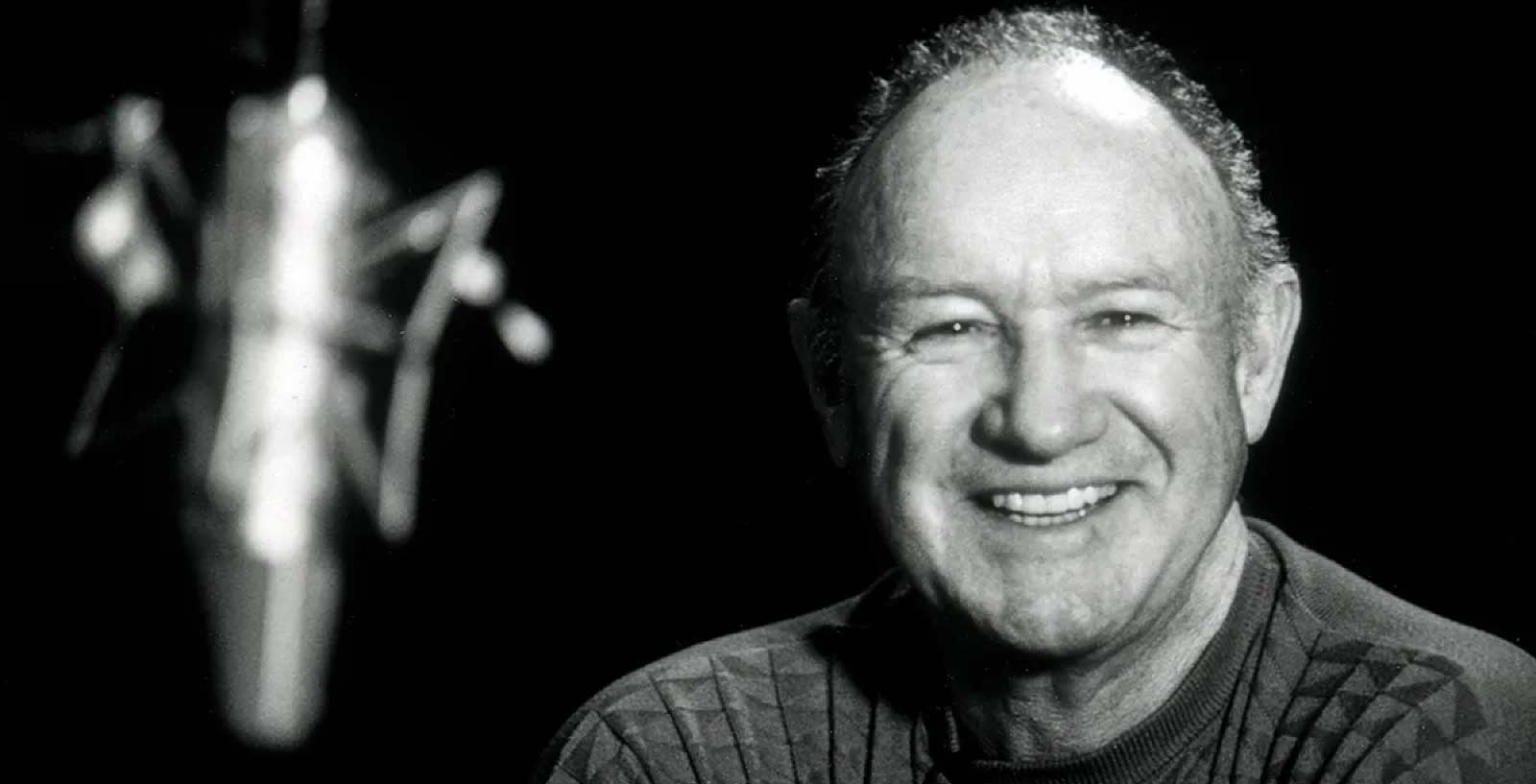

Hope you are all doing well.The S&P 500 and the NASDAQ fell for the second week in a row as tariff threats escalated again and technology stocks slipped. The NASDAQ finished down about 3.5% for the week while the S&P 500 retreated 1.0%. The Dow was an outlier, as it rose 1.0%. For the month, the NASDAQ took the biggest hit among the major U.S. indexes, retreating around 4.0% in February, while the S&P 500 and the Dow fell 1.4% and 1.6%, respectively. Things may get a bit worse before it gets better but I still believe the overall direction of the stock market will be higher. Gene Hackman passed away this week. I have broken down this week’s update using some of his notable quotes.

“Don’t piss in my ear and tell me it’s raining.” – Gene Hackman

Investors and consumers are not buying that tariffs are innocuous and can be implemented without causing harm to our economy. Yields of U.S. government bonds fell to their lowest levels in nearly three months as investors shifted to safety. The yield of the 10-year U.S. Treasury note closed on Friday around 4.19%, down from 4.42% at the end of the previous week and a recent peak of 4.80% in mid-January. Consumer confidence recorded its biggest monthly decline in three and a half years. The Conference Board’s Consumer Confidence Index came in at a reading of 98.3, down from January’s revised 105.0 figure and well below economists’ expectations. Survey participants cited fresh concerns about inflation risks. While tariffs could be somewhat harmful to the economy, it remains to be seen which proposed tariffs will actually be implemented and what their impact will be. Therefore, it is best not to overreact to the headlines.

“That’s the great thing about plankton. It pretty much keeps to itself.” – Gene Hackman

Corporate earnings move along unfazed by all the volatility causing headlines. Earnings growth continues to provide the oxygen for this bull market. Earnings season concluded this week with Nvidia posting huge revenue growth and beating expectations. Companies in the S&P 500 posted an average earnings gain of 17.8% over the same quarter a year earlier. That result marked the strongest growth since the fourth quarter of 2021 and was up sharply from the 11.8% growth rate that analysts had expected heading into earnings season. The financial sector alone posted a 56.0% earnings gain, the highest among all 11 sectors. This widespread earnings growth should fuel the next leg of this bull market and push stocks higher long term. The takeaway, markets overreact to short term news events. Earnings are what drive stock prices and corporate earnings at the moment are great. View dips in the stock market as a buying opportunity.

If you’d like to speak about your investments or your plan, or if it has been a while since our last review. Please use my calendar link below and schedule a phone or zoom appointment.