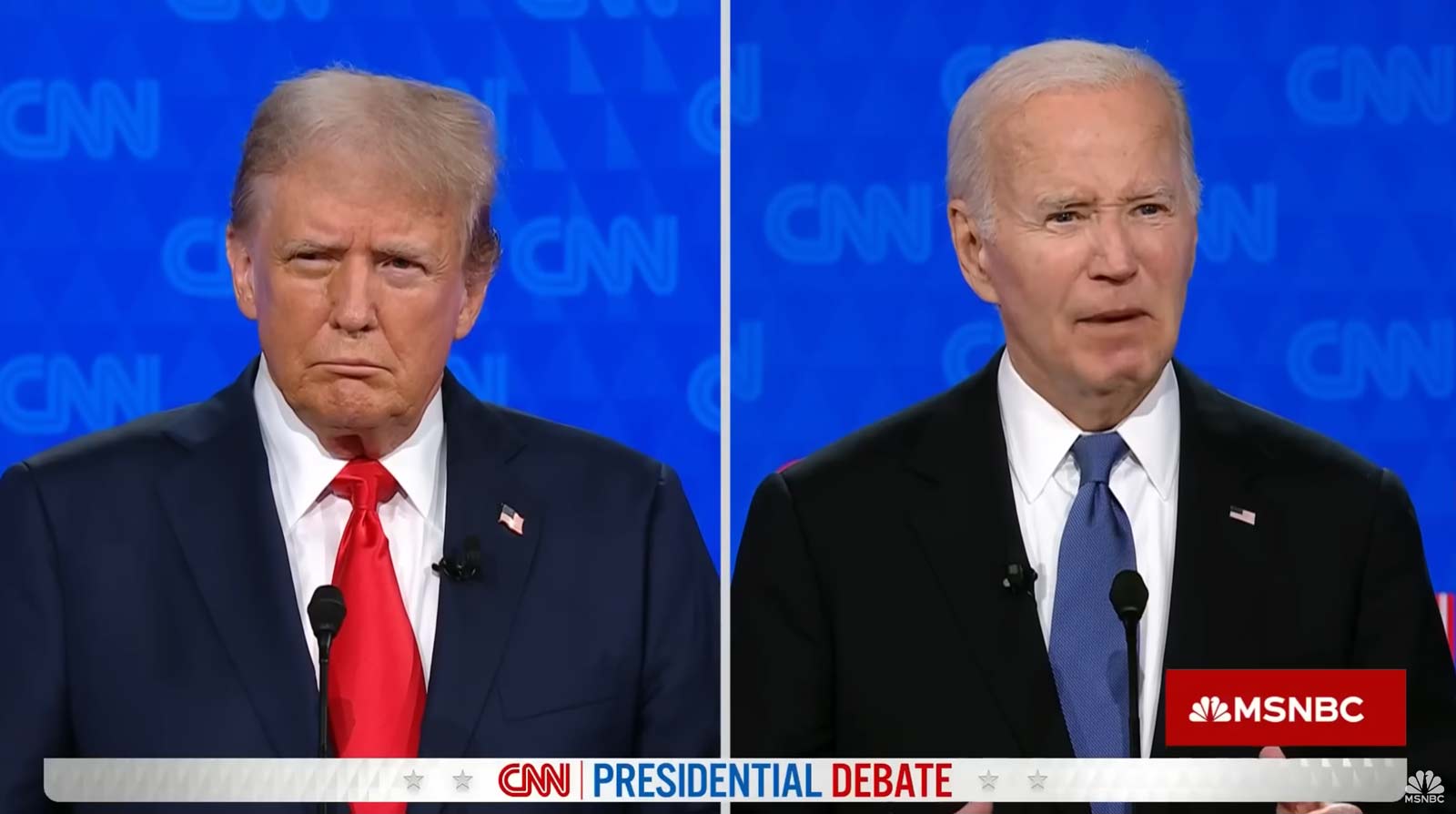

Hope you are all doing well. The S&P 500 posted a tiny weekly decline while the NASDAQ rose slightly as both indexes remained near record-high levels in a quiet week of trading. The Dow slipped, remaining about 2% below the record that it set six weeks earlier. The S&P 500 ended June with a monthly advance that totaled 3.5% as the index posted its seventh positive month out of the past eight. The NASDAQ outperformed its peers with a nearly 6.0% gain in June while the Dow lagged with a rise of 1.1%. The first Presidential debate was this week, I have broken down this week’s update using quotes from the debate.

We have never done so well. Every – everybody was amazed by it. – Trump

The current stock market has financial pundits speaking in hyperbole about how great it is. The stock market, as measured by the S&P 500, has booked a 15% return at the halfway mark this year. This is among the top-seven best starts in the last 35 years, with the S&P 500 setting more than 30 new record highs year-to-date. Great first halves are not often indicative of markets that are about to slow down. In fact, in the 11 years in which stocks were up 10% or more at the end of June, the average full-year return went on to be 29%. Stay invested even if we get the correction that we are overdue for it will likely rebound and go higher by year end.

I doubt whether you’ll accept it – Biden

For most of the year investors have been doubting the market, that is starting to change. At midyear 2024, the VIX (an index that measures investors’ expectations of short-term U.S. stock market volatility) was slightly below its year-end 2023 level and down a whopping 35% from its year-to-date high reached on April 15. The escalation of tension in the Middle East in April, has really been the only pocket of market volatility this year and that drop was only 5%.

I gave him a country with no, essentially no inflation. It was perfect. It was so good. – Trump

Trump is correct in that we had very low inflation below the Fed’s 2% target for much of his presidency, However, we are headed closer and closer to bringing inflation down to the target. The U.S. Federal Reserve’s preferred inflation gauge (Personal Consumption Expenditures excluding energy and food prices), otherwise known as the core inflation index rose at an annual rate of 2.6% in May, marking the slowest price growth in more than three years.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment.