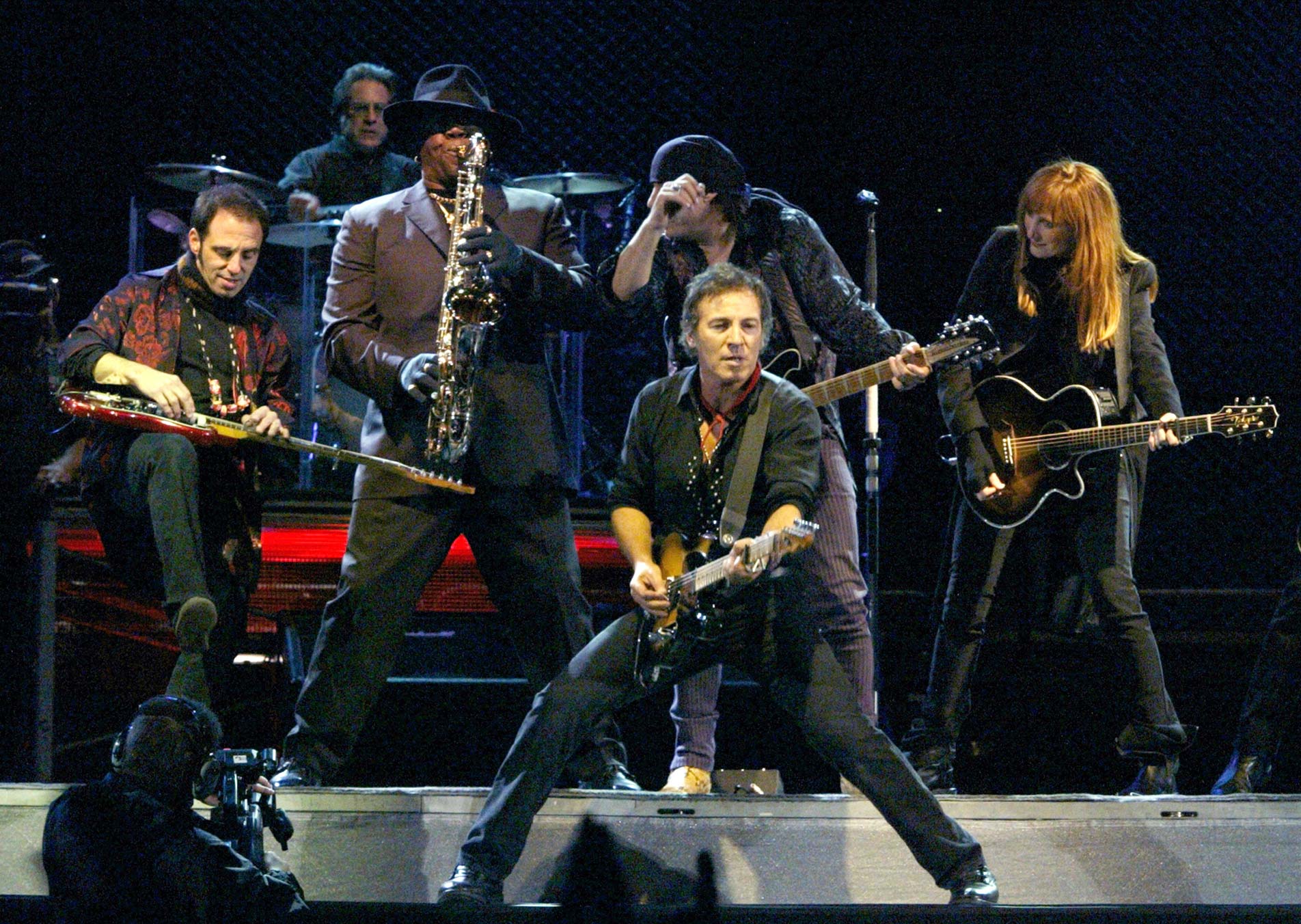

Hope all is well with you. This will be my final update of 2021, so I want to wish everyone a happy and healthy Holiday season and New Year. In the wake of a rally the previous week, the major U.S. stock indexes retreated for the third week out of the past four. Trading was choppy throughout the week, and the NASDAQ underperformed the S&P 500 and the Dow by wide margins. The big technology stocks had a rough week which led to the lag in growth stocks. On Thursday, Bruce Springsteen sold his music catalog in a deal rumored to be worth 500 million dollars, the largest such deal ever recorded. I have broken down this week’s news using songs from that catalog.

The Rising — Bruce Springsteen

As expected, the U.S. Federal Reserve accelerated the pace at which it will phase out its pandemic-era program that’s been purchasing $120 billion in bonds each month. The Fed taper is now expected to end by March 2022 instead of next June. More importantly, most Fed officials now see three interest-rate increases as likely in 2022, up from the single increase that had been projected a few months ago. The Federal Reserve wasn’t the only major central bank to announce a policy shift in response to inflation concerns. The Bank of England raised its key interest rate on Thursday, becoming the first major central bank to do so during the pandemic.

Should you be concerned about the rate hikes? An initial hike is not necessarily an immediate or inevitable catalyst for a correction. In the last 35 years, there was only one instance of a 10% stock-market correction in the six months leading up to the first Fed rate hike (2015). The growth the stock market has experienced makes it more vulnerable to a 10% correction in 2022. If it happens, it will be a buying opportunity not a harbinger of something more severe like a bear market. The economic and corporate-profit growth remains record setting and my belief is that will continue.

Reason to Believe — Bruce Springsteen

Entering the final two weeks of the year, projections from Wall Street analysts indicate that 2021’s earnings growth rate for S&P 500 companies could reach 45%. If that year-over-year forecast is achieved, it would mark the highest annual growth rate since FactSet began tracking this metric in 2008. Over the past 10 years, growth has averaged 5%. To paraphrase the song, it struck me kinda funny that investors would sell their growth stocks against that backdrop. Sure, rising rates are not great for growth companies but you pair 45% earnings growth with healthy household finances, clearing labor shortages and supply bottlenecks, persistent business investment and you have the recipe for a bull market not a bear. I don’t think this bull run will surpass the duration of the last cycle (longer than 10 years, 2009 – 2020), but the reports of its demise have been greatly exaggerated.

I am here to help at any time. If you would like to schedule a phone/web conference appointment, I have included a link to my calendar below and you can self schedule.