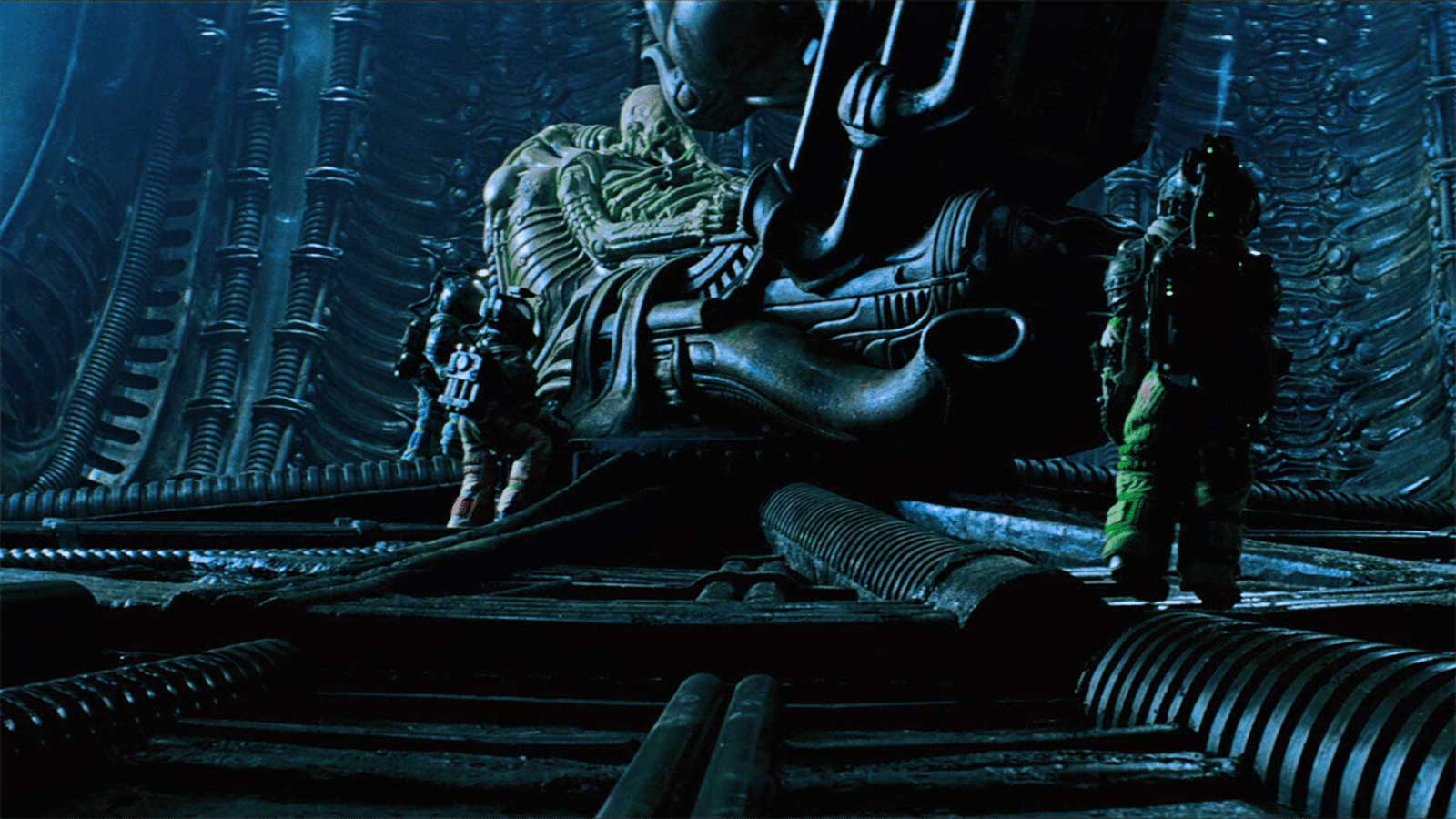

Hope you are all doing well. The major U.S. stock indexes recorded their strongest weekly gains of 2024. The NASDAQ surged more than 5%, the S&P 500 added 4%, and the Dow rose 3%. Information technology stocks that pulled the broader stock market lower in the previous week’s sell-off were among the leaders of the latest week’s sharply positive results. The tech sector’s 7.6% average gain was a big reason why the NASDAQ outperformed the S&P 500 and the Dow, which have lower weightings in tech than the NASDAQ. The newest installment of the Alien movie franchise hit theaters Friday. I have broken this week’s update using quotes from the original film.

“We’ll go step by step and cut off every bulkhead and every vent until we have it cornered”- Ripley (Sigourney Weaver)

The Federal reserve has been trying to keep prices stable using everything in their tool kit to keep inflation from growing. It seems to be working, CPI slipped below 3% to 2.9% for the first time since early 2021, and a separate report on wholesale prices came in better than forecast. I still think the Fed will not relax in their fight against inflation and don’t expect them to cut rates in September. That is not what the market thinks and the inflation numbers did reinforce expectations for an interest-rate cut next month. We will get some more insight next week as to the path forward. The Federal Reserve will hold its annual three-day economic policy symposium beginning Thursday, August 22. Fed Chair Jerome Powell is among the featured speakers, with an address scheduled on Friday.

“I admire its purity. A survivor… unclouded by conscience, remorse, or delusions” – Ash (Ian Holm)

The economy is surviving and despite all the talk of recession consumers keep spending without remorse. U.S. retail sales beat expectations. The 1.0% month-over-month sales gain in July surpassed economists’ consensus forecast for around 0.4%. Another encouraging sign came later on Thursday, when new claims for unemployment benefits fell relative to the previous week. Strong consumer spending and a healthy labor market are signs that the chances of recession are not as high as feared a couple weeks ago.

If you’d like to speak about your investments or your plan, my calendar link is below and you can schedule a phone or zoom appointment.