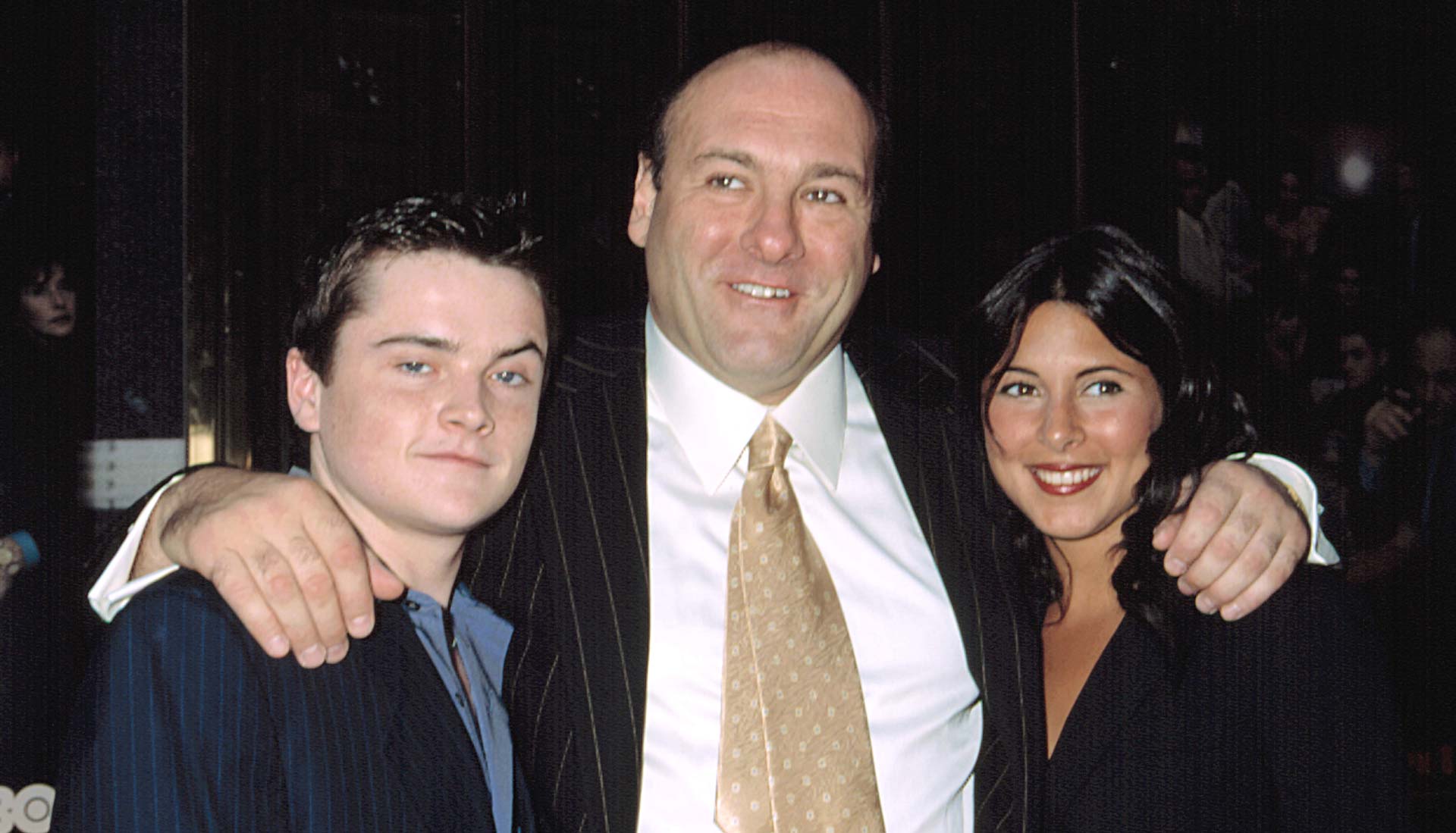

Hope you are all doing well. After posting small gains in the previous week, the major U.S. stock indexes turned downward, continuing on the bumpy path they’ve been on in the wake of a mostly positive summer. The NASDAQ dropped more than 3%, the S&P 500 declined more than 2%, and the Dow fell more than 1%. This week also saw the return of the Sopranos, with a new movie, I have broken down this week’s news using quotes from the Sopranos.

The U.S. debt ceiling can impact every facet of every market and every economy across the globe. A stopgap spending bill was passed, funding the government until early December. This alleviated some but not all of the anxiety for the market. The real focus should be on the approaching debt ceiling, which, without being raised, is expected to be hit in mid-October, raising fears of a looming government default. Both sides of the aisle know the debt limit must be raised, but neither side wants to bear the burden of being seen as championing more federal debt – which already exceeds $28 trillion. It will eventually get increased, but likely at the last minute, because the cost of not doing so would be far greater. The political drama and brinkmanship between now and then will continue to cause volatility.

Federal Reserve Chair, Jerome Powell hopes to tighten fed policy without the market and/or the economy hitting the rocks. Current rising-rate concerns represent a temporary source of volatility for stocks. We’ve seen similar episodes of rising rates, both earlier this year as well as during the last cycle when the Fed first announced its intentions to taper bond purchases. Each experience caused the stock-market rally to hiccup but didn’t choke off the broader bull market. Don’t expect market volatility to disappear quickly. Expect ongoing swings, and temporary weakness, but the market’s path is ultimately higher. Friday, producing evidence of this after coming under pressure for much of last week, Friday’s rally left the market just 4% below all-time highs.

I am here to help at any time. If you would like to schedule a phone/web conference appointment, I have included a link to my calendar below and you can self schedule. The link will allow you to schedule either phone or zoom.