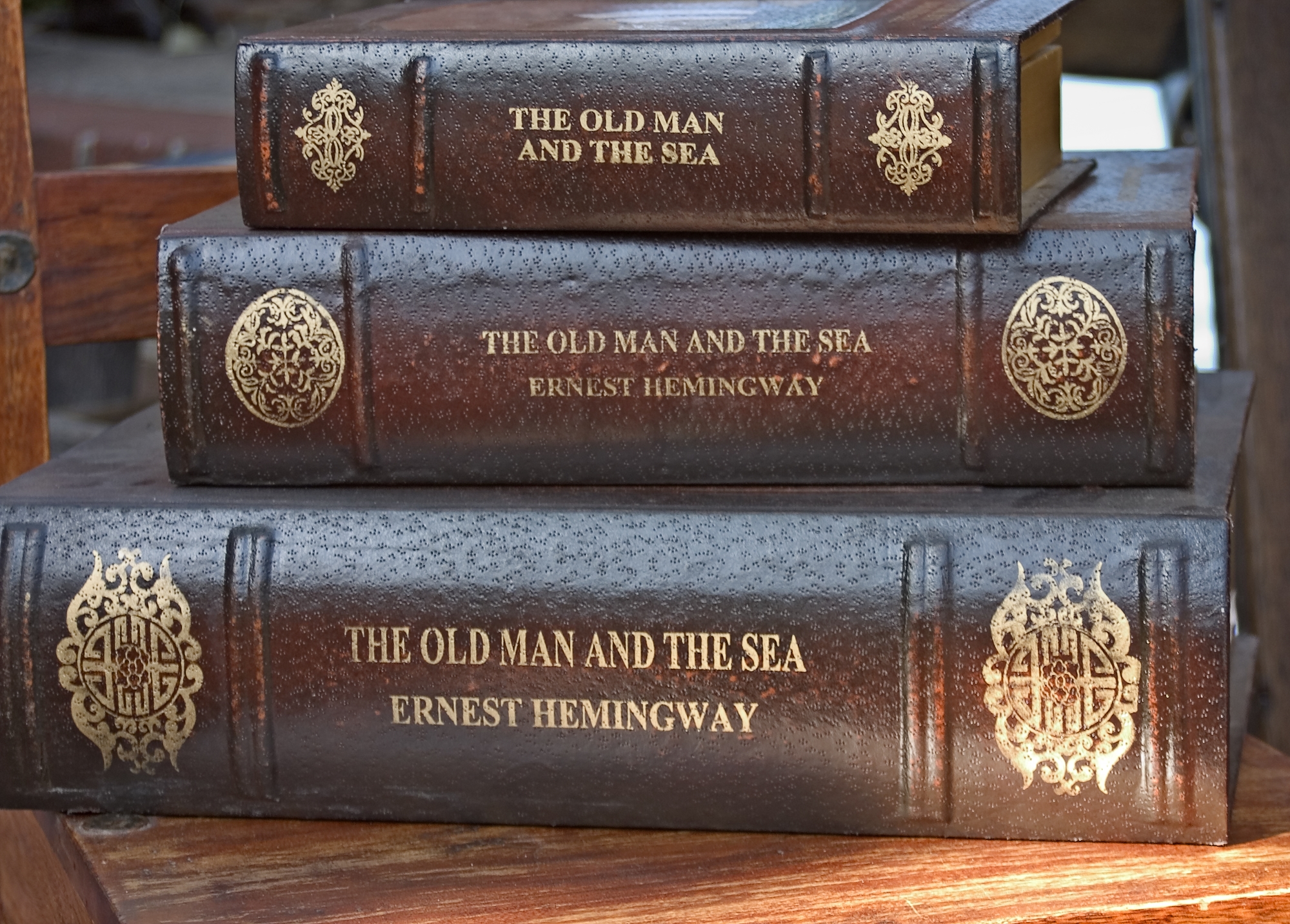

U.S. stock indexes rallied on Monday, and the positive momentum extended through most of the week, lifting the S&P 500 and the NASDAQ above previous record highs set in early May and late April. Overall, the S&P 500, the NASDAQ, and the Dow added roughly 3% for the week. I have broken down this week’s market news using quotes from Ernest Hemingway’s The Old Man and The Sea.

I would rather be exact. Then when luck comes you are ready.

Some 13 years after the financial crisis, we are still stress testing our banks. Like Santiago being precise with his fishing line in the book, the Federal Reserve designed the tests to make sure large banks won’t buckle under severe global recessionary conditions. The results showed that all 23 banks comfortably passed the stress test.

He no longer dreamed of storms.

Fed Chairman Jerome Powell largely walked back last week’s pessimistic inflation forecast in testimony before Congress. Powell downplayed the recent spike in consumer prices indicating he believes the inflation will eventually ease.

Now is no time to think of what you do not have. Think of what you can do with what there is.

President Biden does not have the votes to get his entire agenda passed, so he is working with what he has. After months of negotiating, a bipartisan group of senators announced an agreement on a roughly $1 trillion plan to improve the nation’s physical infrastructure. The White House will now try to move the package through Congress. The agreement focuses on traditional infrastructure such as roads and bridges as well as water infrastructure and broadband. The compromise comes with no new taxes because it is funded by repurposing unused pandemic relief funds, tougher Internal Revenue Service tax collection, and selling oil from the Strategic Petroleum Reserve.

I am here to help at any time. If you would like to schedule a phone/web conference appointment, I have included a link to my calendar below and you can self schedule.